With banks and credit unions across the country adapting to the ‘new normal,’ Austin-based Q2’s mission to help them provide seamless digital banking experiences has never been more important.

Q2 powers online banking portals and mobile apps that bring hundreds of community financial institutions to digital parity with massive national banks. Historically, about 50% of bank customers visit digital banking applications. But during the crisis, that percentage has spiked, at times stressing the systems and requiring quick action and communication from the Q2 team.

Long a Pendo customer, Q2 turned to its Pendo dashboards to make sense of changes in usage and to launch an in-app messaging campaign. This helped banks adapt to swiftly changing circumstances and ensured Q2 could continue providing high-touch service to their customers.

« L'une des choses que nous avons pu constater, c'est que les clients de notre clientèle éprouvent des difficultés avec leurs opérations financières, révèle Michael Vasquez, directeur produit chez Q2. Mettre à disposition un produit tel que Pendo pour les accompagner tout au long de cette expérience est une demande que nous avons énormément reçue. »

At first, the jump in usage that caused an outage appeared to be a potential distributed denial of service attack. But, using Pendo’s analytics, Vasquez quickly diagnosed the true cause: a surge in users trying to log in—double the amount normally seen on a Monday.

Michael Vasquez a ainsi pu déterminer la cause du problème en s'intéressant à l'utilisation des pages de connexion, de chargement et de renvoi des banques et institutions financières sur les principales applications Web et mobile de Q2. Résultat : ce même lundi durant lequel l'entreprise enregistrait un pic d'activité était également le jour où les paiements liés au plan de relance étaient réalisés sur les comptes bancaires de millions d'Américains, les utilisateurs souhaitant donc s'en assurer en consultant leur compte.

Il ne s'agissait donc pas d'une cyberattaque crainte par les équipes de Q2, mais bien d'un déferlement d'activité. Une fois le problème identifié, l'équipe informatique a pu ajouter de la capacité aux clients ayant subi cette hausse, afin de s'assurer que Q2 puisse à nouveau faire face à un tel incident.

Covid-19 has forced many of the financial institutions that Q2 serves to accelerate their digital transformation initiatives—or for others, launch them from scratch. For many of their account holders, it represented their first digital banking experiences.

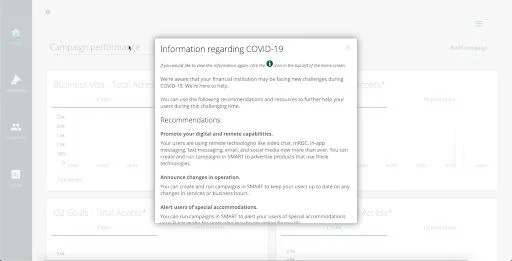

Early in the crisis, Pendo helped Q2 quickly communicate with banks in-app. Vasquez and his team deployed guides across Q2’s various apps, delivering information about virus-related changes and advice for financial institutions that found themselves suddenly navigating a new business landscape.

When businesses came to Q2’s customers seeking loans under the stimulus bill and were forced to carry out the whole process virtually, Vasquez and the Q2 team were able to use Pendo tooltip guides to walk users through digital loan applications, providing information about fields that many found confusing. What’s more, it was completed quickly — without requiring a line of code to be written.

Pour Michael Vasquez, pas de doute : disposer d'un outil tel que Pendo pour identifier des tâches ou des processus générant de la confusion ou de la frustration chez les clients et guider les utilisateurs tout au long de leur expérience a considérablement augmenté le taux de réussite de la transformation numérique des clients de Q2.

Q2 was able to adapt so quickly to the Covid-19 crisis thanks to a years-long investment in Pendo. The company originally brought the tool in for its analytics capabilities, vetting Pendo along with Mixpanel, Kissmetrics, Google Analytics, AppDynamics, and Heap. But Pendo’s retroactive analytics, the ability to use that data to segment and target users, and ease of designing guides without engineering help were the deciding factors in Q2’s selection.

Pendo’s in-app messaging and guidance capabilities made adding self-service support and onboarding new users with walkthroughs and tooltips simple for Vasquez’s team. In one case, a simple tooltip explaining the difference between a user’s “current balance” and their “available balance” was viewed 3,000 times and effectively eliminated one of the most commonly submitted support tickets.

« Pouvoir ajouter une infobulle en seulement 10 à 15 minutes s'est avéré un fantastique atout pour notre équipe », souligne M. Vasquez.

Now, Q2 is using Pendo to offer its customers the ability to see their own usage analytics for their instance of Q2 and deploy in-app messaging to their own customers in a white-labeled instance. Vasquez and his team plan to start rolling Pendo out in other Q2 products soon.