Les 10 indicateurs clés de performance que tout responsable produit se doit de connaître en 2025

Faites défiler pour lire

Table des matières

In a rush? Download the PDF for later

Download the E-BOOKDes indicateurs indispensables au succès de vos produits et de votre entreprise

Introduction : Les défis et les opportunités modernes du leadership en matière de produits

Que signifie mesurer le succès de votre produit et de votre entreprise ?

Il existe naturellement quelques indicateurs piliers sur lesquels nous pouvons toujours compter : l'augmentation du nombre d'utilisateurs actifs, l'adoption du produit et la fidélisation client, autant d'éléments indispensables à la réussite commerciale à long terme.

But things are slightly different these days. For example, Gartner predicts that 75% of enterprises will operationalize AI by 2025. AI is rapidly changing modern enterprise operations, and many of these businesses are working in real time to understand just how to measure success. All the while, work and leadership practices are changing—automation, vibe coding, and user intelligence are just the tip of the iceberg.

Être responsable produit en 2025 exige un savant équilibre entre maîtrise technique et vision stratégique, afin de faire toute la part des choses. Grâce aux nouvelles technologies et aux nouvelles façons de faire, les responsables produit se sentent pousser des ailes : l'heure est venue de mener leur produit au succès.

Dans ce guide, nous nous appuyons sur notre expérience auprès de plus de 14 000 clients au cours de l'année écoulée pour discuter des 10 indicateurs clés de performance que tout responsable produit doit connaître. Si nous nous en tenons principalement à ce que nous considérons comme des indicateurs clés de performance essentiels à toute équipe produit, nous nous intéressons également à la manière dont l'IA change la donne.

Comprendre ce qui est essentiel pour mesurer le succès d'un produit

Faisons un petit tour d'horizon pour comprendre les différents types d'ICP dans une perspective globale. Voici trois catégories à garder à l'esprit :

- Business outcomes: What are your most crucial business outcomes, and how does your product impact key business and financial outcomes in the short and long term? These might be closely tied to reducing churn, increasing long-term user retention, or bringing in new users or subscribers.

- Product usage: These KPIs reflect how users behave inside your product. Which features do they use the most? Where are they getting stuck? These metrics are critical for understanding how users do or do not find value in your software.

- Product performance: These KPIs measure how well your product performs its intended function. What is your product response time? How much downtime did you experience last month? It’s often best to set an internal benchmark for quality metrics and measure yourself against it monthly or quarterly.

Les 10 ICP essentiels pour 2025

Lors de la sélection des principaux ICP, nous avons pris en compte les indicateurs qui sont susceptibles d'aider les responsables produit à suivre les aspects fondamentaux de leurs applications, tels que les coûts, l'adoption des fonctionnalités et le sentiment des utilisateurs. Ces indicateurs répondent aux exigences simultanées d'innovation et de stabilité. Ils vous aident à comprendre comment vos utilisateurs interagissent avec votre logiciel afin de réduire l'attrition tout en obtenant des insights clés sur ce qu'ils pourraient souhaiter à l'avenir.

1. Valeur vie client prédictive (CLTV)

Chacun sait qu'il est beaucoup plus coûteux d'acquérir de nouveaux clients que de les fidéliser. C'est pourquoi il est essentiel de comprendre la valeur vie d'un client à long terme.

Les modèles CLTV traditionnels, qui s'appuient sur des moyennes historiques, ont du mal à prendre en compte des variables dynamiques telles que les changements de comportement induits par l'IA ou les perturbations de la chaîne d'approvisionnement. Pour être plus compétitives, les entreprises se tournent vers des modèles prédictifs pilotés par l'IA pour comprendre comment les décisions actuelles peuvent influencer les revenus futurs.

La CLTV prédictive intègre l'apprentissage automatique pour analyser les flux de données en temps réel, y compris les modèles d'interaction des utilisateurs, les tendances macroéconomiques et les événements géopolitiques. Ces modèles peuvent utiliser des données transactionnelles, des indicateurs du comportement des utilisateurs et des préférences en matière de fonctionnalités ou de produits.

Un fournisseur de logiciels B2B peut, par exemple, utiliser la CLTV prédictive pour allouer des ressources à des secteurs à fort potentiel, tels que la santé ou les énergies renouvelables, où les changements réglementaires créent des opportunités de croissance.

Pourquoi la CLTV est-elle importante ?

La CLTV prédictive vous permet de mieux comprendre la valeur de vos produits et s'appuie sur l'apprentissage automatique pour fournir des estimations plus précises. Elle vous aide également à appréhender la manière dont les utilisateurs sont susceptibles d'adopter de nouvelles fonctionnalités, en particulier celles basées sur l'IA.

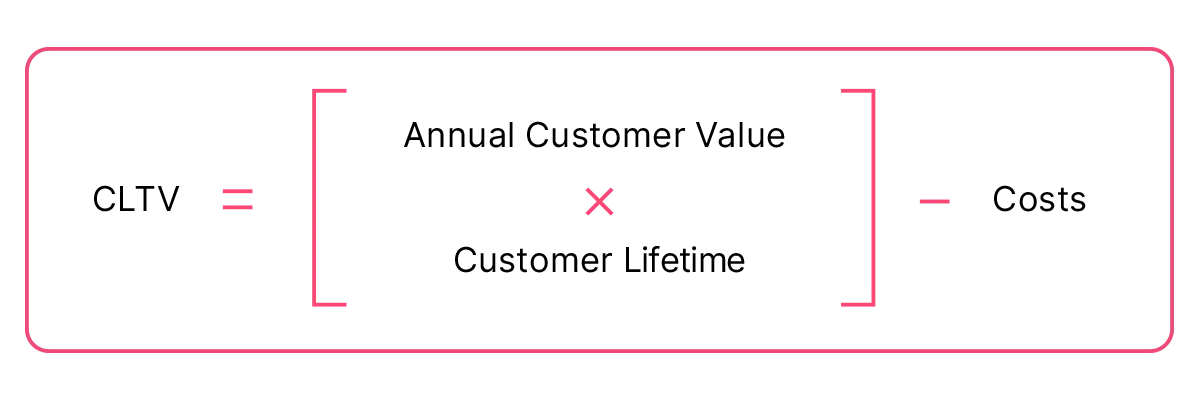

Comment calculer la CLTV ?

La CLTV est simple à calculer : prenez la valeur annuelle d'un client, multipliez-la par la durée de vie moyenne du client (en années d'abonnement ou de licence), puis soustrayez les coûts d'acquisition ou de maintenance (tels que les coûts généraux d'acquisition de clients, les coûts de retour sur investissement ou d'autres indicateurs).

2. Taux d'adoption des fonctionnalités d'IA

L'adoption de fonctionnalités est par essence un indicateur d'activation de l'utilisateur. Dans le cas d'un produit d'IA, elle démontre clairement la valeur immédiate et permanente que vos produits d'IA apportent aux utilisateurs.

Cet ICP mesure le niveau d'engagement des utilisateurs avec les fonctionnalités d'IA telles que les chatbots, les rapports automatisés ou l'analyse prédictive. Un faible taux d'adoption peut être le signe d'un décalage entre les besoins des utilisateurs et la conception des fonctionnalités. Une plateforme CRM pourrait par exemple découvrir que ses prévisions de ventes basées sur l'IA sont sous-utilisées en raison d'un manque de formation, ce qui inciterait à repenser l'expérience d'onboarding au sein de l'application.

En comprenant comment votre base d'utilisateurs utilise les fonctionnalités d'IA, votre équipe est plus à même d'aider les utilisateurs et d'encourager l'adoption continue.

Pourquoi le taux d'adoption des fonctionnalités d'IA est-il important ?

Le suivi de l’adoption de l’IA contribue au retour sur investissement. Une faible adoption est le signe d'une mauvaise conception des fonctionnalités ou d'un onboarding défaillant. En revanche, une forte adoption est liée à la fidélisation et à l'augmentation du chiffre d'affaires. Mesurer l'engagement avec des chatbots ou des analyses prédictives permet aux équipes d'affiner les expériences utilisateur et de justifier les coûts de développement de l'IA.

Comment mesurer le taux d'adoption des fonctionnalités d'IA ?

Le taux de l’adoption est exprimé en pourcentage de votre base totale d'utilisateurs ayant accès à la fonctionnalité :

Comment augmenter l'adoption des fonctionnalités

One of the core benefits of measuring adoption is understanding how to drive customers towards the functionality that would benefit them, making them more likely to stay engaged with your product. When it comes to driving adoption of key features, it’s most effective to do so within the product itself. In-app tactics to boost feature adoption include:

- Utiliser les messages in-app pour annoncer de nouvelles fonctionnalités.

- Utiliser des tutoriels in-app pour guider les utilisateurs vers des fonctionnalités spécifiques et faciliter l'onboarding.

- Utiliser la segmentation pour cibler vos communications auprès des clients susceptibles d'apprécier une fonctionnalité donnée.

Cas pratique : zoom sur Okta

Mesurer les expériences utilisateur implique de comprendre votre base d'utilisateurs à un niveau granulaire. Okta a constaté que la solution Pendo l'aidait à comprendre l'expérience de ses clients et à identifier les opportunités d'amélioration.

« Nous pouvons segmenter, cibler et recibler les utilisateurs sur l'ensemble des canaux en fonction des données à notre disposition, afin de leur offrir des conseils utiles, de les guider et de les encourager à utiliser des éléments essentiels de la configuration d'Okta. »

Tom Witczak, directeur de l'expérience numérique, Okta

3. Croissance des utilisateurs

La croissance pourrait être l'indicateur le plus important de la santé de votre organisation. Considérez la croissance comme le reflet des efforts de sensibilisation de votre marque : dans quelle mesure attirez-vous de nouveaux utilisateurs ? Dans quelle mesure vos efforts sont-ils efficaces pour accroître l'utilisation parmi votre base d'utilisateurs existante ?

Pourquoi la croissance du nombre d’utilisateurs est-elle importante ?

Comme le dit le vieil adage, « ne pas croître c'est commencer à mourir ». Les variations des indicateurs de croissance peuvent aider les équipes à identifier les problèmes liés à la communication, à l'expérience utilisateur et à d'autres préoccupations. La « croissance » elle-même peut varier en tant que catégorie, mais pour les plateformes logicielles, celle-ci est directement liée à l'élargissement de la base d'utilisateurs et, par la suite, à l'expansion des revenus.

Cela étant dit, vous pouvez également mesurer la croissance sur la base d'autres facteurs, comme le temps passé par certains utilisateurs sur votre plateforme ou l'utilisation de certaines fonctionnalités.

Mesurer la croissance des utilisateurs au fil du temps

La clé pour mesurer la croissance des utilisateurs est de comprendre les repères temporels essentiels. Pour la plupart des plateformes logicielles par abonnement, les périodes les plus cruciales sont les mois et les années. Plus précisément, il s'agit de mesurer la croissance du nombre d'utilisateurs d'un mois à un autre et d'une année à une autre.

La formule permettant de mesurer la croissance du nombre d'utilisateurs actifs mensuels (MAU) peut varier en fonction de l'horizon temporel. Par exemple, pour mesurer la croissance d'un mois à l'autre, vous devez déterminer le pourcentage de croissance de cette période :

Cette croissance est exprimée en pourcentage. Pour la mesurer sur une période plus longue, il vous suffit d'étendre cette formule. Par exemple, pour mesurer la croissance du début à la fin de l'année, la formule serait la suivante :

4. Product Engagement Score (PES)

Le SEP est un indicateur général de la santé globale de votre produit. Il associe des paramètres qui mesurent la régularité, l'adoption et la croissance, permettant ainsi de prendre le pouls du produit en un coup d'œil. Il est toutefois possible de se pencher plus en détail sur les indicateurs qu'il englobe afin de détecter les points sensibles et y remédier.

Pourquoi le SEP est-il important ?

Le SEP permet d'obtenir un éclairage sur la façon dont les utilisateurs adoptent et continuent d'utiliser un produit ou une fonctionnalité au fil du temps. C'est également un excellent moyen d'avoir une vue d'ensemble de la performance d'un produit ou d'une fonctionnalité, ce qui vous donne une idée des points à creuser afin de mieux comprendre chaque ICP.

How to measure PES

Le SEP est composé de trois éléments : la régularité, l'adoption et la croissance. Une fois ces valeurs calculées, vous pouvez obtenir votre SEP en faisant la moyenne de ces trois chiffres puis en multipliant le résultat par 100 :

Vous pouvez choisir de mesurer votre SEP en fonction des visiteurs ou des comptes. Si votre produit est uniquement utilisé par des personnes isolées, et non des équipes, optez plutôt pour une mesure du SEP au niveau des utilisateurs. Si vous visez l'acquisition de nouveaux comptes, mesurez votre croissance (et votre SEP global) à ce niveau pour refléter au mieux cette stratégie. Dans le doute, efforcez-vous d'harmoniser la configuration de votre SEP avec les priorités globales actuelles de votre entreprise.

Un meilleur SEP = de meilleurs résultats commerciaux

The Pendo data science team challenged itself to predict customer churn, usage, and growth rates using PES alone. They found that accounts with higher PES in the months leading up to the end of a contract were more likely to renew, while lower scores correlated with churn. Just six months of PES scores created a reliable indicator of renewal.

5. Délai de rentabilisation (TTV)

Sur les marchés concurrentiels, les utilisateurs s'attendent à un retour sur investissement immédiat. Le TTV mesure la rapidité avec laquelle les utilisateurs réalisent leur première « action clé » (une action décisive démontrant la valeur), telle que la réalisation d'une analyse de données dans un outil de BI ou le déploiement d'un code via une plateforme DevOps. Un TTV lent est souvent associé à des taux d'abandon élevés. Par exemple, une plateforme de conception Web no-code peut réduire le TTV en guidant les utilisateurs à travers des workflows modélisés, leur permettant ainsi de lancer une page de renvoi en quelques minutes.

Voici quelques éléments clés à prendre en compte lors de l'examen du TTV :

- User onboarding efficiency: How quickly can users navigate the product effectively?

- First meaningful outcome (FMO): When does the user complete their first foundational task (creating a report, scheduling a meeting, etc.)?

- Réalisation de la pleine valeur : quel processus un utilisateur suit-il pour réaliser pleinement un projet, un artefact ou un résultat avec votre produit ?

Pourquoi le délai de rentabilisation est-il important ?

Les utilisateurs exigent d'accéder à la valeur le plus rapidement possible. Raccourcir le TTV en rationalisant l'onboarding réduit le taux d'abandon et permet de se différencier de la concurrence, en particulier sur les marchés SaaS saturés.

Comment calculer le TTV ?

Il n'existe pas de formule générale pour calculer le TTV : comprendre cet indicateur implique de définir clairement la proposition de « valeur » (utilisation d'une fonctionnalité, déploiement d'un processus ou d'une pratique particulière, etc.) ainsi que le point de départ de votre mesure (à partir de la première inscription, de la première connexion ou d'une autre étape importante). Sur la base de ces critères, le TTV sera exprimé de préférence en jours, en minutes voire en secondes.

6. Performance du produit

La tolérance des utilisateurs aux problèmes de performance a fortement diminué, et des retards d'une seconde peuvent suffire à éroder la confiance. Cet ICP quantifie la disponibilité et la réactivité avec des seuils tels qu'un temps de disponibilité de 99,9 % et un temps de chargement inférieur à 2 secondes pour les actions clés. Par exemple, une plateforme de commerce électronique qui subit des retards lors du processus de paiement pendant les pics de trafic court un risque d'abandon de panier et une dégradation de sa réputation.

Voici quelques indicateurs de performance critiques à comprendre :

- Temps de disponibilité moyen du système

- Temps de chargement des pages

- Temps de réponse aux tickets des utilisateurs

- Scores de satisfaction des utilisateurs

Pourquoi la performance produit est-elle importante ?

Les indicateurs de performance (temps de disponibilité, temps de réponse) seront incontournables en 2025. Un retard d'une seconde peut réduire les conversions de 7 %, ce qui implique des temps de chargement quasi instantanés et une disponibilité de 99,9 % pour fidéliser les utilisateurs. Cela est particulièrement vrai dans des secteurs tels que le commerce électronique ou la fintech.

Comment votre produit se positionne-t-il par rapport à la concurrence ?

Product performance benchmarks don’t exist in a vacuum. They are best understood when compared to other internal metrics or data from peers in your industry. With that in mind, Pendo compiled data from over 6,800 applications across 2,500 of our customers to help teams benchmark their products based on region, company size, and industry. See how your product stacks up with the interactive benchmarks.

7. Augmentation des revenus grâce à la personnalisation

Cet ICP mesure l'augmentation du chiffre d'affaires provenant d'expériences personnalisées, telles que la tarification dynamique ou les recommandations de contenu sur mesure. Par exemple, une plateforme d'apprentissage en ligne pilotée par l'IA qui personnalise les suggestions de cours pourrait atteindre des taux d'achèvement et de renouvellement d'abonnement plus élevés.

Déterminer le retour sur investissement en fonction de la personnalisation signifie lier directement les avantages supplémentaires de la personnalisation aux gains de revenus et aux économies de coûts. Les approches peuvent inclure :

- Identifier les indicateurs clés liés à l'adoption et à la fidélisation des utilisateurs, tels que l’adoption des fonctionnalités, la valeur à vie et le taux d’attrition. Il est essentiel d’établir une base de référence avec ces critères.

- Associer les approches de personnalisation aux indicateurs, comme l'utilisation de l'IA générative pour créer des messages in-app ou le suivi de l'analyse comportementale pour fournir une assistance opportune aux utilisateurs qui interagissent avec des fonctionnalités clés.

- Experimenting with A/B tests to help link specific personalization tasks with positive business results.

Pourquoi le retour sur investissement de la personnalisation est-il important ?

L'hyperpersonnalisation pilotée par l'IA stimule l'engagement mais elle doit être mesurée pour justifier les dépenses qui y sont associées. Mesurer l'augmentation du chiffre d'affaires résultant d'expériences personnalisées (par exemple, la tarification dynamique) permet de s'assurer que les efforts sont alignés avec les résultats de l'entreprise.

Cas pratique : zoom sur Alarm.com

Alarm.com voulait s'assurer que ses représentants du service client puissent répondre aux besoins des utilisateurs grâce à des guides et à des fonctionnalités d'assistance personnalisés. Grâce aux analyses de Pendo, l’entreprise a utilisé des parcours et des entonnoirs pour mieux comprendre ce que les clients pensaient et ressentaient afin d’adapter le contenu à leurs besoins spécifiques.

« Cela a eu une influence considérable sur le travail des agents et sur le sentiment général lors du lancement du centre d'assistance. De plus, cela nous permet de développer nos activités, car nous passons beaucoup moins de temps à élaborer des formations désynchronisées en mettant au point des ressources sur le tas. »

Mary Kidd, responsable des systèmes, opérations clients chez Alarm.com

8. Taux d'attrition prédictif

L’attrition reste un indicateur essentiel, mais les modèles prédictifs identifient désormais les utilisateurs à risque avant qu’ils ne partent. Les modèles d'apprentissage automatique attribuent des scores de risque d'attrition (0 à 100) en analysant les baisses d'engagement, les historiques de paiement et les tendances de sentiment. Par exemple, un service de streaming pourrait signaler les utilisateurs qui réduisent leur temps de visionnage après une augmentation des prix, déclenchant ainsi des offres de fidélisation ciblées.

Pourquoi le taux d'attrition prédictif est-il important ?

Les modèles prédictifs identifient les utilisateurs à risque avant qu'ils ne partent en analysant les baisses d'engagement et les tendances de paiement. Des stratégies de fidélisation proactives (par exemple, des offres ciblées) réduisent l’attrition, préservant ainsi les revenus dans les modèles par abonnement.

Comment mesurer l'attrition prédictive

Traditionnellement, l'attrition peut être exprimée par la formule :

However, predictive churn is more forward-looking. It means using analytics and monthly trends to determine potential churn in upcoming months. Machine learning and AI can provide deeper analysis.

9. Net Promoter Score (NPS)

Vos utilisateurs recommanderaient-ils votre marque ? Sinon, vous pourriez utiliser le NPS pour comprendre leurs sentiments à propos de leur expérience avec vos produits.

Généralement, un NPS est recueilli en sondant les utilisateurs et les clients, en distinguant les « promoteurs » des « détracteurs » selon leurs réponses, puis en exprimant cette relation sous forme de ratio entre les deux.

Ces scores offrent un excellent aperçu des pensées et des sentiments des utilisateurs, notamment lorsqu'ils sont recueillis directement dans le logiciel. Les réponses sont contextuelles et opportunes, fournissant des moyens d'aborder les problèmes de manière proactive plutôt que réactive. Cela rend le NPS particulièrement utile en tant que système d’alerte précoce pour l’insatisfaction et les expériences des clients.

Pourquoi le NPS est-il important dans les boucles de feedback ?

Understanding customer sentiment is always worthwhile, and tracking NPS consistently helps you see how customers will advocate for you now and down the road. However, NPS is a qualitative measure, which means it works best in conjunction with quantitative data—like product usage—to support it.

Cas pratique : zoom sur Cision

Cision souhaitait savoir ce que les nouveaux clients ressentaient à propos de la marque et, plus précisément, comment des scores NPS plus élevés émergeaient de différents comportements des clients. Grâce à Pendo, l'entreprise a réalisé des études NPS ciblées pour identifier quels indicateurs rendaient les clients plus susceptibles de promouvoir la marque.

« La possibilité de regrouper les données au niveau du compte a fait toute la différence. Aucun des autres outils d'analyse que nous utilisons n'est capable d'une telle prouesse. »

Becky Banasik, vice-présidente de la réussite client, Cision

10. Vitesse de transformation du feedback en fonctionnalité

Cet ICP mesure la rapidité avec laquelle les équipes traduisent les retours des utilisateurs en améliorations du produit. Par exemple, un outil de gestion de projet pourrait donner la priorité aux demandes de fonctionnalités des utilisateurs expérimentés et publier des mises à jour lors de sprints trimestriels.

Pourquoi la vitesse de transformation du feedback en fonctionnalité est-elle importante ?

Votre plateforme ou produit est continuellement développé selon un modèle de développement SaaS. Les retours des utilisateurs s'avèrent donc essentiels pour pallier les limitations du logiciel et fournir un produit qui répond aux besoins d'une base d'utilisateurs établie (et, idéalement, fidèle).

Comment mesurer la vitesse de transformation du feedback en fonctionnalité

Cette mesure est exprimée sous la forme d'une période moyenne entre les retours initiaux des utilisateurs ou les évaluations alpha et la mise en œuvre de fonctionnalités liées à ces retours. Vous pouvez puiser dans vos commentaires et plateformes de feedback pour voir comment les boucles de feedback entraînent des changements incrémentiels et documenter combien de fonctionnalités de production ont résulté de retours directs ou indirects des utilisateurs.

Cas pratique : zoom sur Filevine

La plateforme juridique Filevine avait déterminé en interne qu'elle devait intégrer des mises à jour continues des fonctionnalités dans son cycle de développement. Elle devait maintenir le logiciel en développement tout en conservant une feuille de route à long terme fondée sur les retours des clients, reflétant les exigences du secteur tout en garantissant la conformité réglementaire. L'entreprise a utilisé Pendo Feedback pour recueillir les réponses des utilisateurs grâce à des demandes de feedback ciblées et contextuelles.

« L'utilisation conjointe des analyses comportementales et des conseils in-app de Pendo avec Pendo Feedback en fait une solution parfaite. Il était essentiel de pouvoir étayer le feedback avec tous les contextes d'utilisation. »

Mary Lyon, directrice du feedback produit, Filevine

ICP durables

Lorsque vous commencez à mesurer, analyser et travailler à l’amélioration des indicateurs clés de performance augmentés par l’IA que nous avons abordés ci-dessus, ne négligez pas les indicateurs clés de performance bien établis (et toujours pertinents). En voici trois qui ne se démoderont jamais :

Net revenue retention (NRR)

Le taux de rétention des revenus nets (NRR) reste une pierre angulaire pour les entreprises basées sur l'abonnement, en partie parce qu'il soutient la fidélisation continue des revenus. Selon McKinsey, les entreprises avec un NRR d'au moins 120 % peuvent espérer obtenir une croissance annuelle de 20 % sans acquérir de nouveaux clients.

Le NRR est la différence entre l'expansion et l'attrition. En général, on s’attend à ce que le NRR ait une valeur supérieure à 100 %, en supposant que vous perdrez des clients, mais que vous trouverez également des moyens d’accroître la valeur des clients que vous conservez.

Comment calculer le NRR ?

Comme le suggère sa définition, le NRR est calculé en soustrayant la perte de clients à l'expansion. Vous aurez besoin de quatre valeurs :

- Revenus récurrents du mois dernier

- Les revenus provenant de l’expansion (ventes incitatives et ventes croisées)

- Revenue lost due to down-sells

- Revenue lost due to churn

En général, les entreprises suivent le NRR sur une base mensuelle ou annuelle. Nous vous conseillons toutefois d'analyser votre taux de rétention des revenus nets chaque mois afin de prendre des mesures opportunes en cas de fluctuations.

Adoption

Les indicateurs de l’adoption valident l’adéquation produit-marché, mais nécessitent désormais une granularité pour distinguer l’utilisation générale du produit et l’engagement avec les fonctionnalités pilotées par l’IA. En 2025, les produits s’appuieront de plus en plus sur des outils d’IA intégrés, tels que des workflows automatisés ou des analyses prédictives, pour se différencier, et (selon Accenture) 97 % des dirigeants considèrent cette évolution comme une transformation pour leur secteur.

Les dirigeants doivent suivre les taux de l'adoption globaux et la manière dont les utilisateurs interagissent avec les différentes fonctionnalités. Par exemple, une plateforme de gestion de projet pourrait surveiller les utilisateurs actifs hebdomadaires (WAU) de sa fonctionnalité de priorisation des tâches pilotée par l'IA, en corrélant ces données avec les taux de vente incitative pour les niveaux premium.

How to measure adoption

L'adoption du produit peut être exprimée au fil du temps par le nombre d'utilisateurs actifs mensuels (MAU), hebdomadaires (WAU) ou quotidiens (DAU). Vous pouvez également mesurer le taux d'adoption du produit en vous basant sur le nombre de nouvelles inscriptions sur une période donnée. La façon dont vous mesurez l'adoption du produit dépendra en grande partie de votre définition du terme « utilisateur actif » du produit. Si votre logiciel est destiné à être utilisé au quotidien, le DAU est sûrement l'indicateur le plus pertinent.

Stickiness

La régularité (la mesure de l'utilisation habituelle d'un produit) a évolué au-delà du suivi des connexions quotidiennes. Les fonctionnalités d’IA telles que les recommandations personnalisées ou les insights prédictifs renforcent désormais l’engagement des utilisateurs au sein d’une application. Par exemple, une application fintech utilisant l’IA pour prévoir les habitudes de dépenses peut enregistrer un retour quotidien des utilisateurs pour vérifier les prévisions budgétaires (ce qui a un impact direct sur la fidélisation).

Les indicateurs modernes de régularité doivent isoler l'engagement piloté par l'IA, en comparant les taux de fidélisation des utilisateurs qui adoptent ces fonctionnalités et de ceux qui s'appuient sur les fonctionnalités traditionnelles.

How to measure stickiness

La régularité s'exprime par le rapport entre les utilisateurs actifs à un moment donné et les utilisateurs actifs sur une période donnée. Par exemple, vous pouvez voir la régularité de votre logiciel un jour donné à l'aide en utilisant le DAU et le MAU :

ICP essentiels, améliorés

L'IA transforme la manière dont les responsables produit suivent et interprètent les ICP, rendant ainsi le succès des produits plus mesurable, prédictif et exploitable que jamais auparavant. Des insights en temps réel sur les utilisateurs à l'analyse automatisée des tendances, les analyses pilotées par l'IA permettent aux responsables produit de dépasser les tableaux de bord statiques et d'adopter une prise de décision dynamique et adaptative.

À mesure que l'IA continue d'évoluer, ceux qui intègrent ses capacités dans le cadre de leurs ICP obtiendront un avantage concurrentiel significatif, garantissant que leurs produits répondent aux demandes actuelles du marché et anticipent les tendances futures.

Pendo aide les entreprises à mesurer et à améliorer les ICP abordés tout au long de ce guide. Utilisez l’analyse produit et les données de déroulé Pendo pour comprendre le comportement des utilisateurs et repérer les points de friction, et l’analyse pilotée par l’IA pour identifier les tendances. En combinant ces données quantitatives avec le feedback qualitatif, les équipes obtiennent une vue complète de l'expérience client. Elles peuvent ensuite agir facilement grâce à des guides in-app no-code qui favorisent l'adoption des produits, stimulent l'engagement des utilisateurs et augmentent le chiffre d'affaires.

Ready to see how Pendo can help you measure and take action on key product KPIs? Get a personalized demo today.