Table des matières

In a rush?

Download the PDF for later

Introduction

Chaque année, Pendo et Product Collective tentent de mieux comprendre ce qu'implique la gestion des produits et l'évolution du rôle de chef de produit en interrogeant des responsables produit travaillant dans différents types d'entreprises à travers le monde. Cette initiative nous permet de prendre du recul et d'apprécier davantage une discipline qui nous tient à cœur. Nous avons donc pris la décision de publier ces résultats pour favoriser les échanges et susciter le débat au sein de notre communauté.

Now in its third year, The State of Product Leadership is bigger and better, casting a global net to understand the priorities and perspectives of product teams in the US, Canada, the UK, France, and Germany. Each year, there are a handful of findings that genuinely surprise us and others that confirm what we generally suspected. In both cases, the insights are instructive–and we think important.

At the end of the report, as is our tradition, we synthesize the 10 findings with several actionable recommendations that we hope will help you put some of these learnings to practice within your organization.

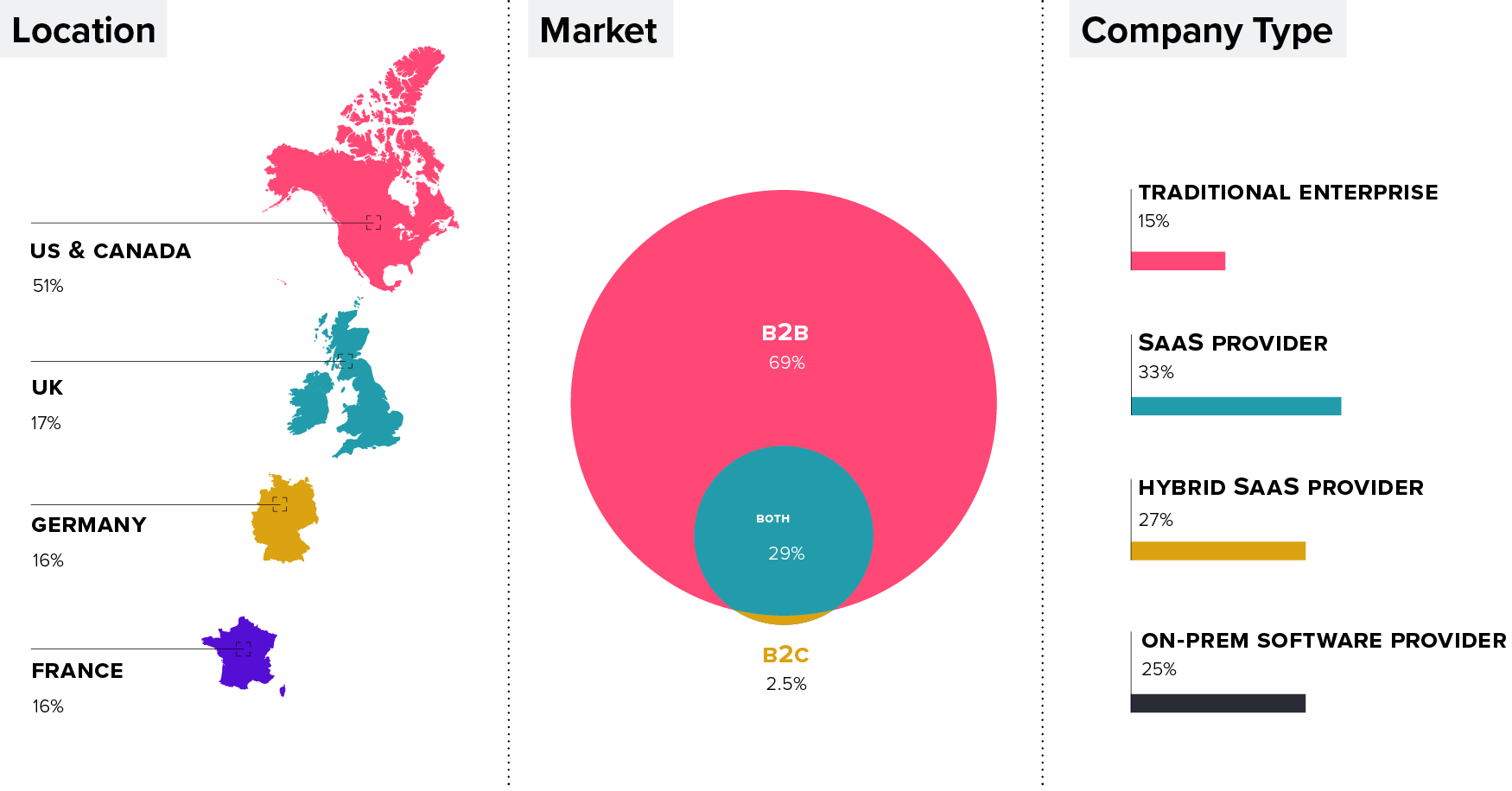

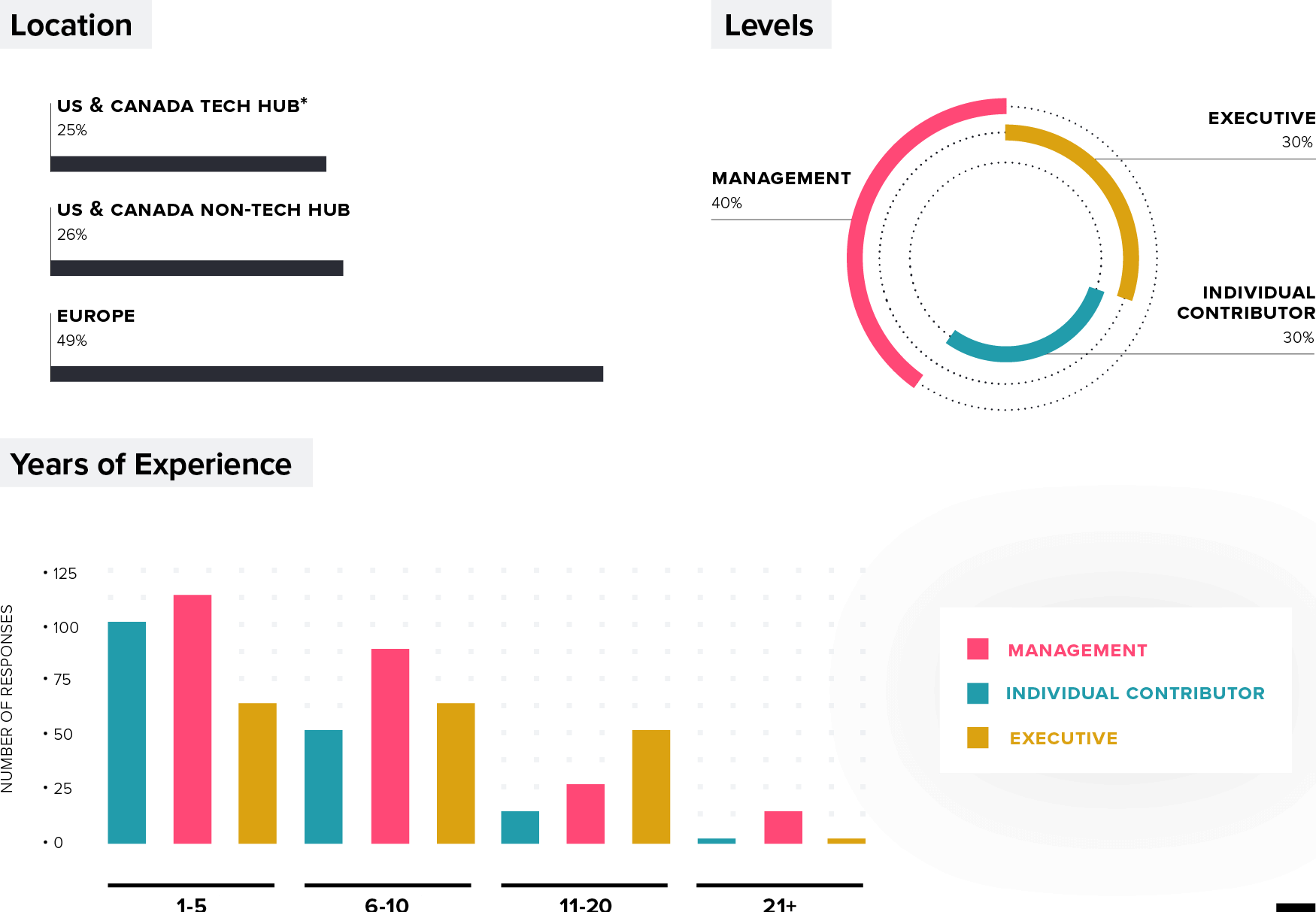

Who We Surveyed

In November of 2019, we surveyed 600 product managers and executives working for largely B2B software companies and traditional enterprises in the US, Canada, the UK, France, and Germany. Here is a summary breakdown of the respondent profile.

* San Francisco / Bay Area, Seattle, Toronto, Washington (DC), New York, Austin, Boston, Denver, Atlanta, Raleigh-Durham per CBRE Research’s “2019 Scoring Tech Talent” report

Key Findings

Veuillez remplir le formulaire ci-dessous pour lire le reste de l'e-book.

Finding 1: Credentials

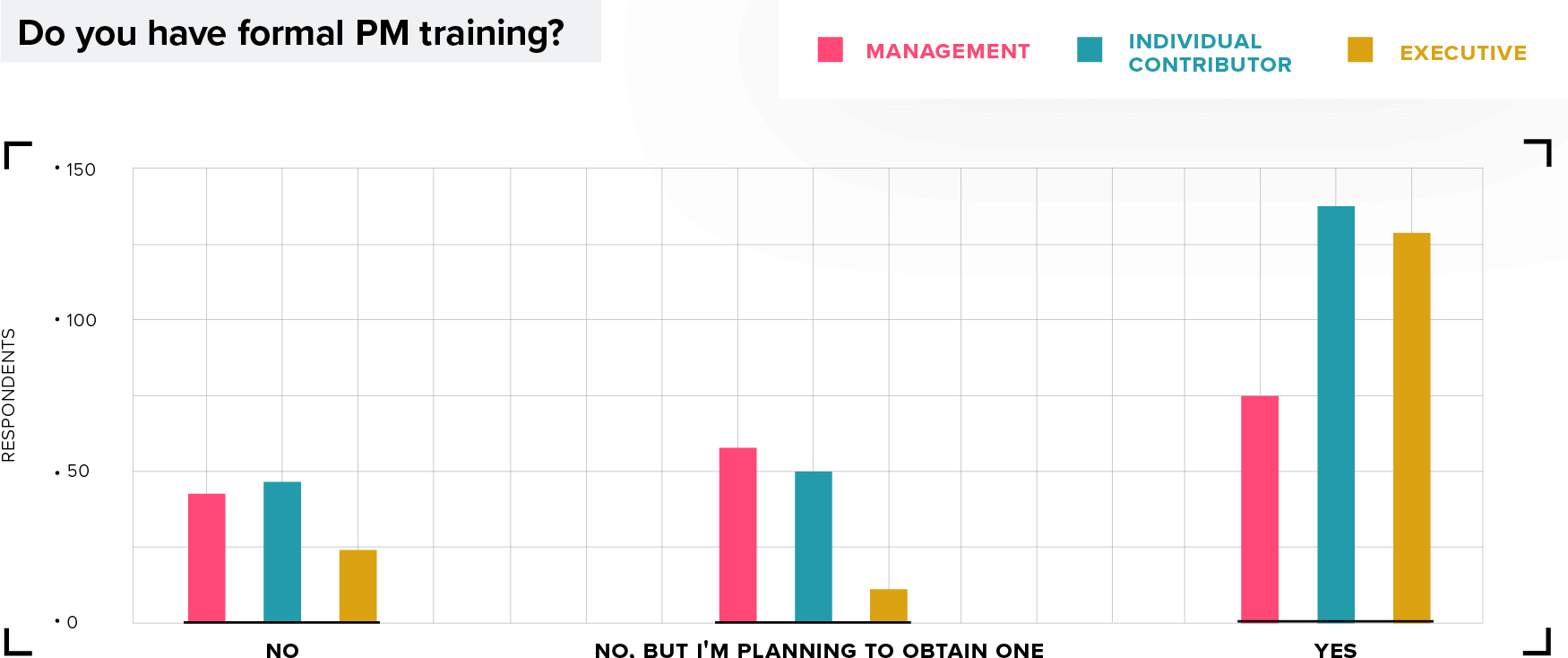

Proving that a credential is more than just a piece of paper, those with an advanced training in product management have achieved higher levels of seniority in their careers.

Product management has always been something that you learn on the job. Sure, there are foundations you’ll pick up in any MBA program and maybe you remember something about human behavior from psych 101 or a marketing class. But, until recently, it hasn’t been easy to find rigorous curriculum for product management. That’s certainly changing.

From Carnegie Mellon’s first-of-its-kind MS in product management and NYU’s MBA concentration in the field, to certificate programs from the University of Washington and Cornell, and practical training programs from General Assembly and Product School, PMs can now go back to school. And that appears to be paying off. We asked product leaders whether they had completed formal PM training. Those who had, by twice the margin, had earned themselves an exec role.

The lesson? Stay in school, kids.

Do you have formal PM training?

Finding 2: Reporting Lines

More than half of product managers now report into a CPO or equivalent, but they also signal the lowest job satisfaction of all reporting lines.

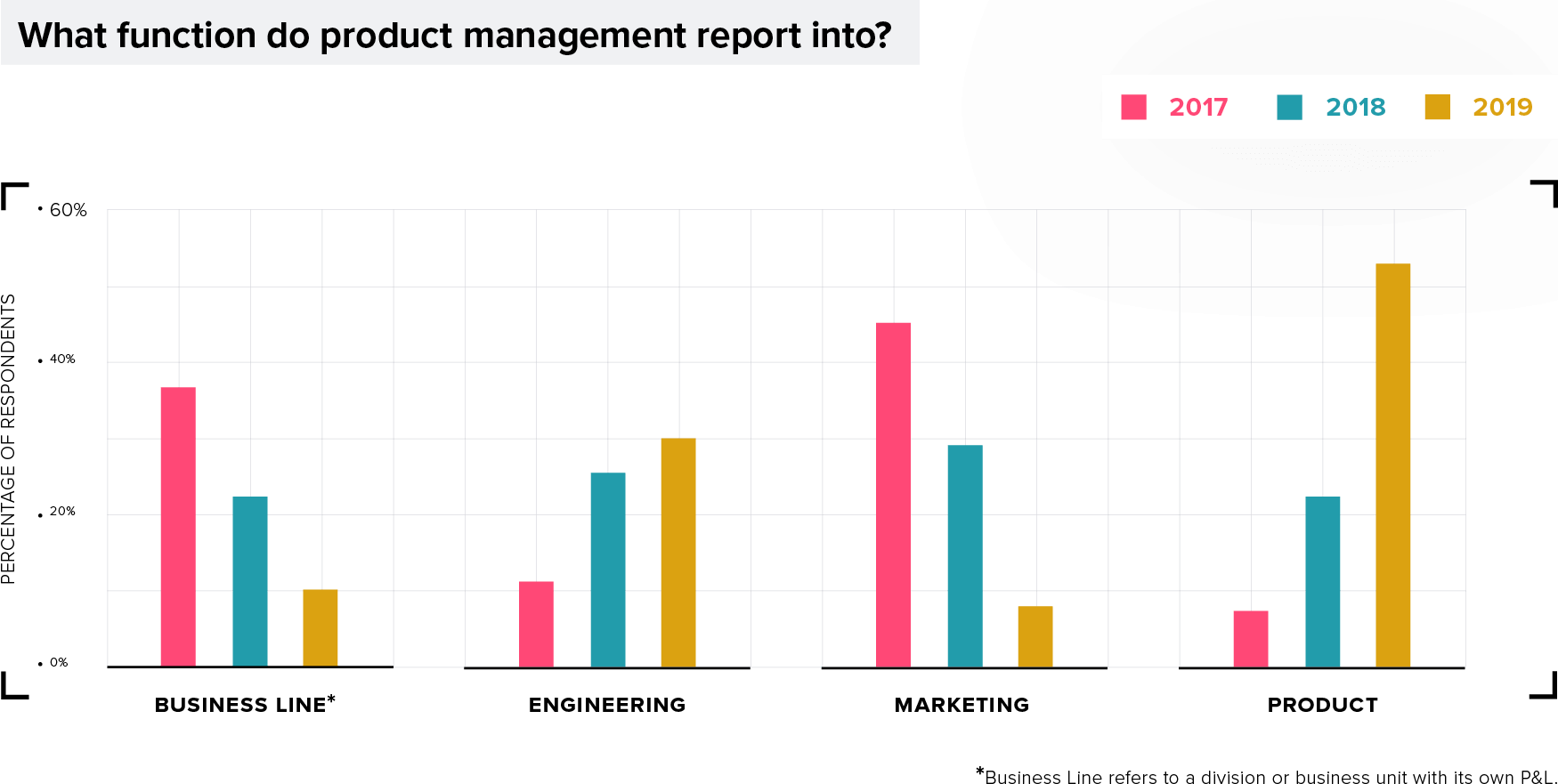

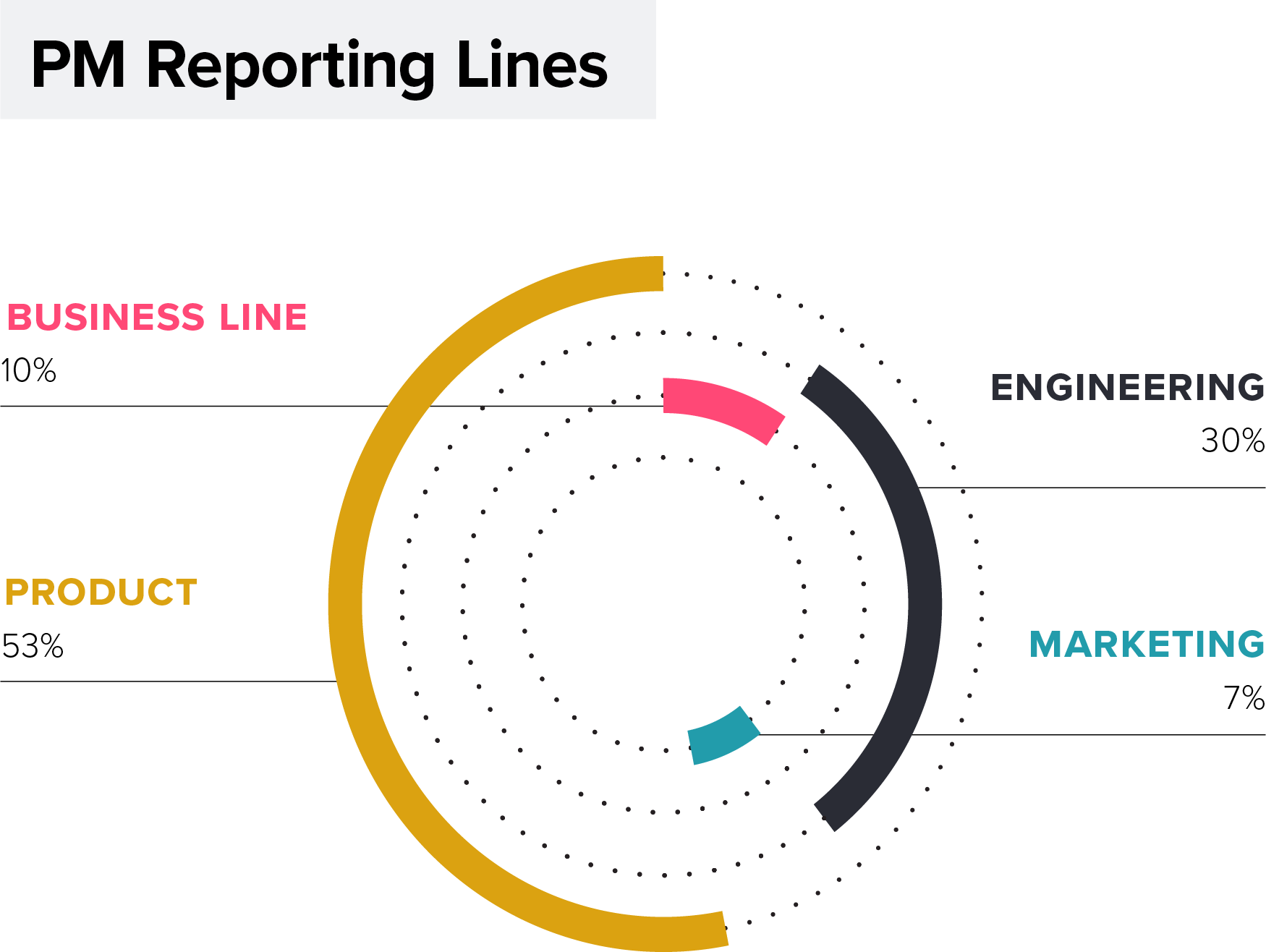

Last year, we saw evidence of the chief product officer (CPO) on the rise, with reporting lines shifting from marketing to a standalone product function under a CPO or equivalent. While marketing was still the dominant reporting line, the sizable shift toward CPOs suggested that something notable was happening here. This year’s study confirms the trend without ambiguity. More than half of product managers now report into a CPO or equivalent, more than doubling in frequency over last year. PMs working for companies in tech hubs (according to CBRE Research’s “2019 Scoring Tech Talent” report), such as San Francisco, Austin, New York, and Boston are slightly more likely to report into a CPO, as are North American PMs who report into a CPO 58% of the time compared to 47% of their European counterparts.

What function do product management report into?

Equally interesting: marketing has gone from first to last in likely reporting lines for product managers. What do we make of this? First, there’s always the possibility of some noise in the data, but a change of this magnitude is more likely indicative of something quite real in PM reporting lines. Interestingly, we’ve seen a steep decline year over year in product teams reporting into marketing and business lines, with an equally dramatic increase in reporting to engineering and, particularly, product leadership. On the basis of this year’s findings and the trends we’ve seen over the last three years, it’s reasonable to conclude that, at least for B2B companies, the age of product managers reporting into the marketing department is coming to an end.

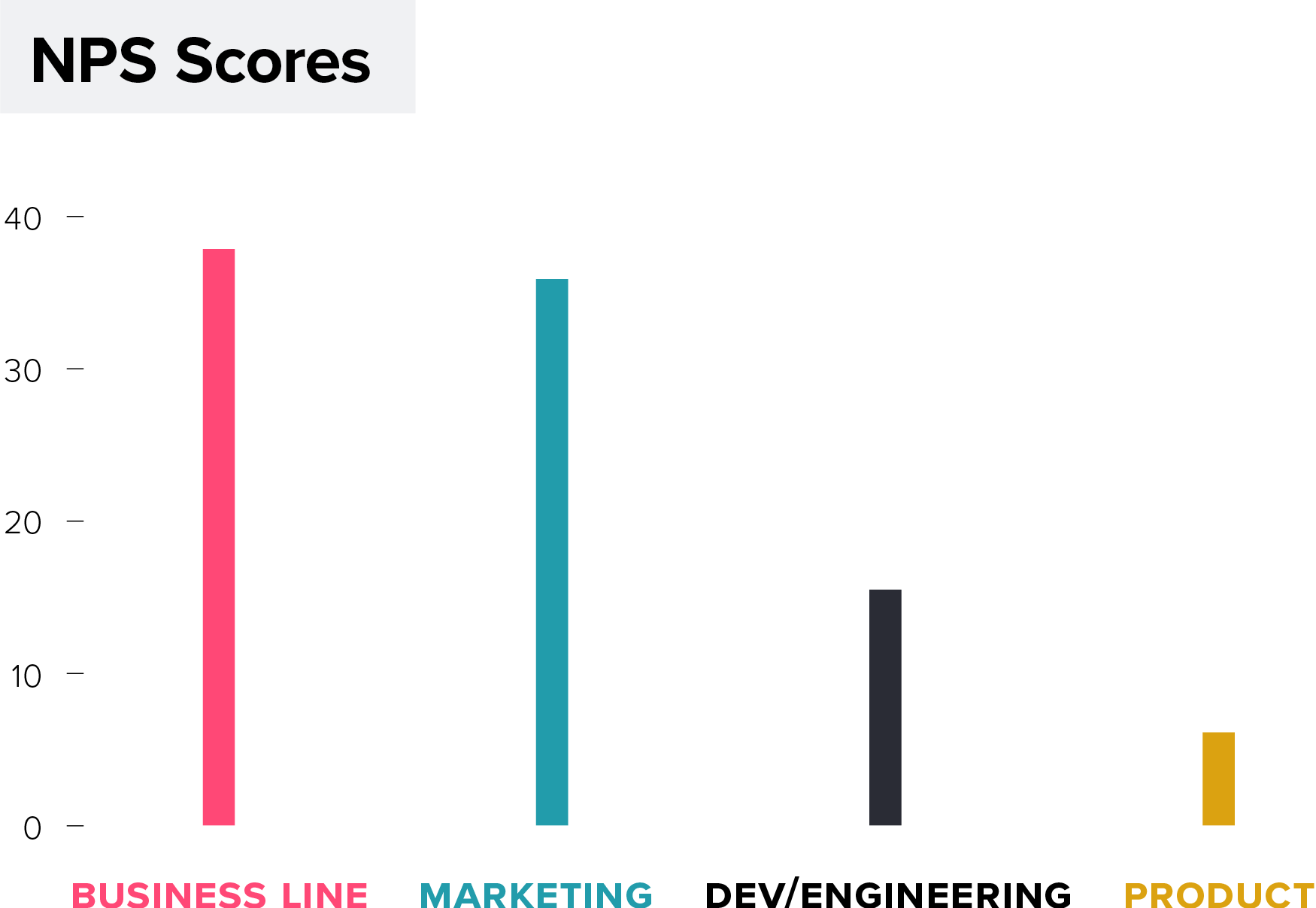

What’s also real are the significant differences in happiness of product managers depending on who they work for. CPOs take note: product managers reporting to you—how can we put this delicately—are a bit blue.

Their average NPS score is significantly lower than the average NPS score of 14 across all reporting lines. Why, we can only 30 speculate, but perhaps a CPO brings a new level of intensity and grind to the discipline. Or perhaps the newness of this function means that many CPOs are still finding their way as managers. Or maybe some of our respondents feel they, as much as anyone, should be in that particular role. Next year we’ll ask some probing questions to better understand the why. Happiness aside, it’s safe to say that the CPO role is quite real—and quite hot.

PM Reporting Lines

NPS Scores

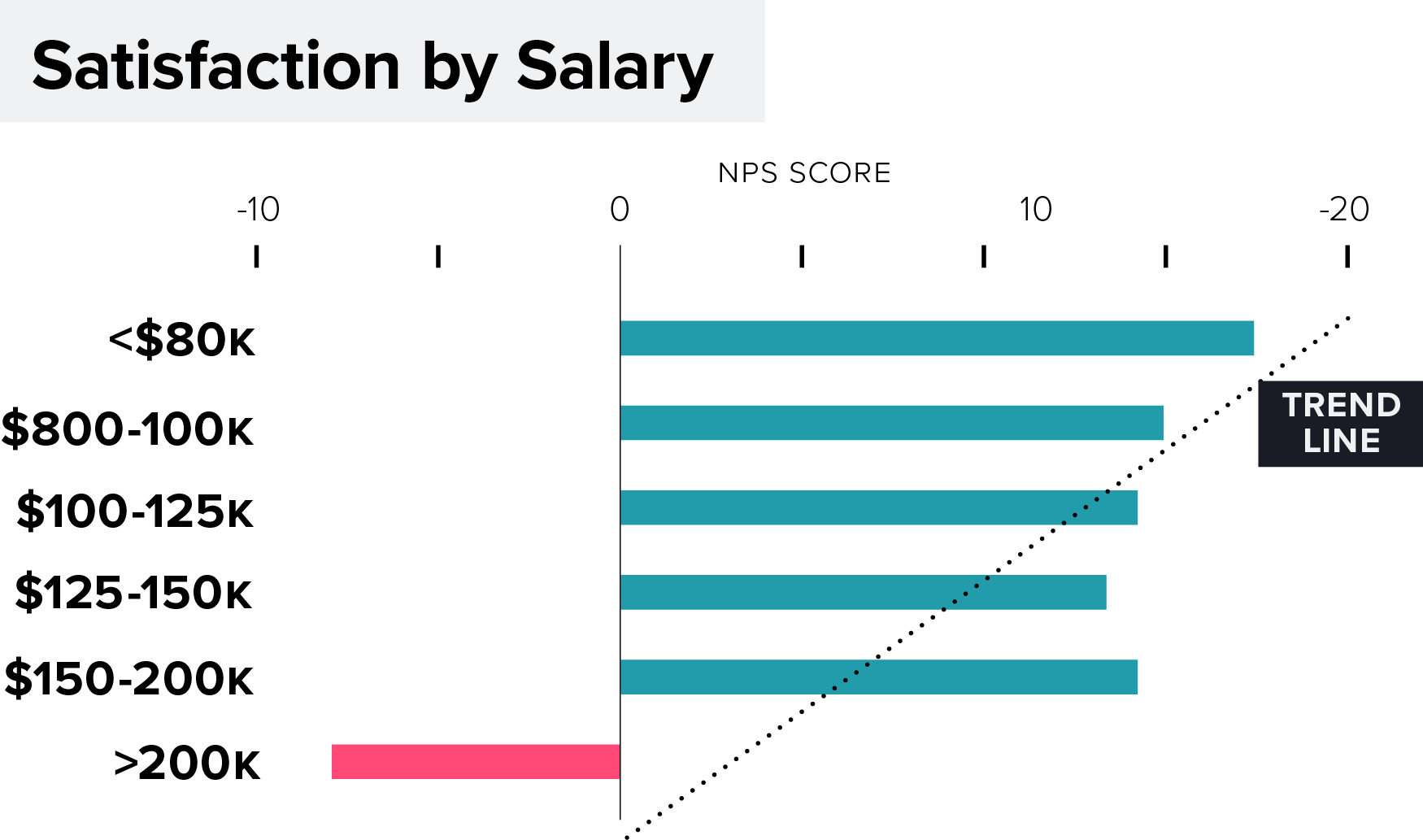

While we’re talking about happiness, it should also be noted that PMs reporting into business lines and marketing—a relative rarity this year—are considerably happier than their peers, with an NPS score more than double the blended average. Call it a happy accident? Perhaps more notable as findings go: Product leaders are considerably less happy as they take on more responsibility and—record scratch—as they earn more money.

Satisfaction by Salary

Remarkably, there’s a negative correlation in earning power and happiness.

This all may point back to the classic burden of product management: accountability without authority. The relative power of the average product team has grown, for sure, often with a seat at the c-team table. But, despite this, the discipline continues to be one of influence, not formal authority.

Engineering, customer success, and marketing—functions PMs depend on to innovate, engage customers, and reach the market—often have separate reporting lines. Adding the complexity of managing a team and a portfolio of products only magnifies this challenge, which may explain the downward slope in happiness in the role as responsibility accrues.

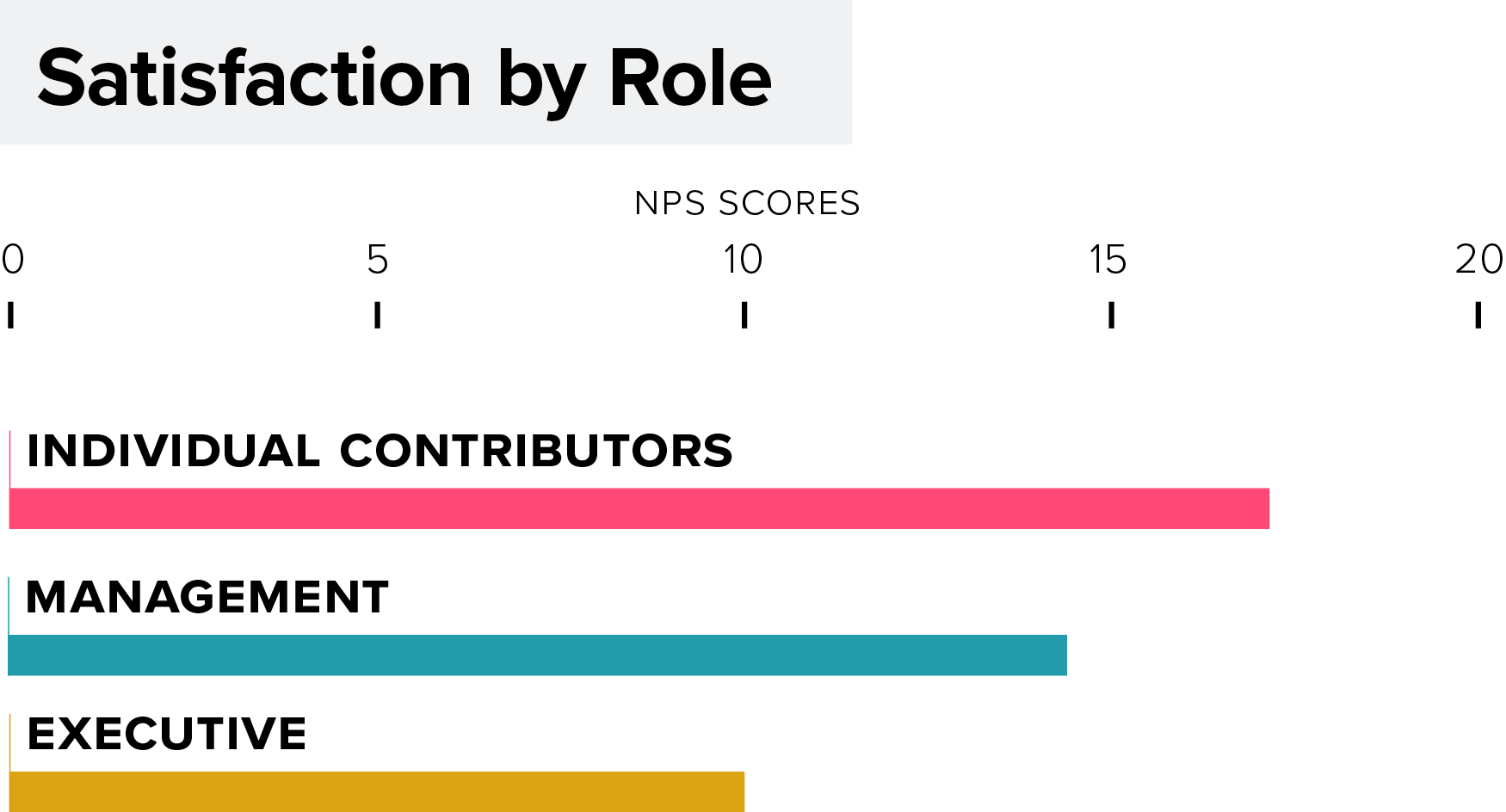

Satisfaction by Role

Individual contributors tend to be happier than managers and executives

Satisfaction by Responsibility

A narrower portfolio produces a happier product manager.

Finding 3: PM Backgrounds

Product leaders are inclined to be the quants not the poets among us, reporting more technical backgrounds and more technical career aspirations.

We’re always interested in understanding how product managers are wired. How they train, how they think, where they come from, and where they’re going. In previous studies, we’ve heard things we’d expect—and a few things that surprised us. For example, last year, PMs told us that they entered product management, more often than not, through a marketing role (a bit surprising), but had a technical educational background (less surprising).

This year, product people identify more as quants than poets, with a decidedly technical bent all around. Given this technical orientation, perhaps it’s no surprise to see such a dramatic shift in PM reporting lines, away from more business-oriented and toward more technically focused functions.

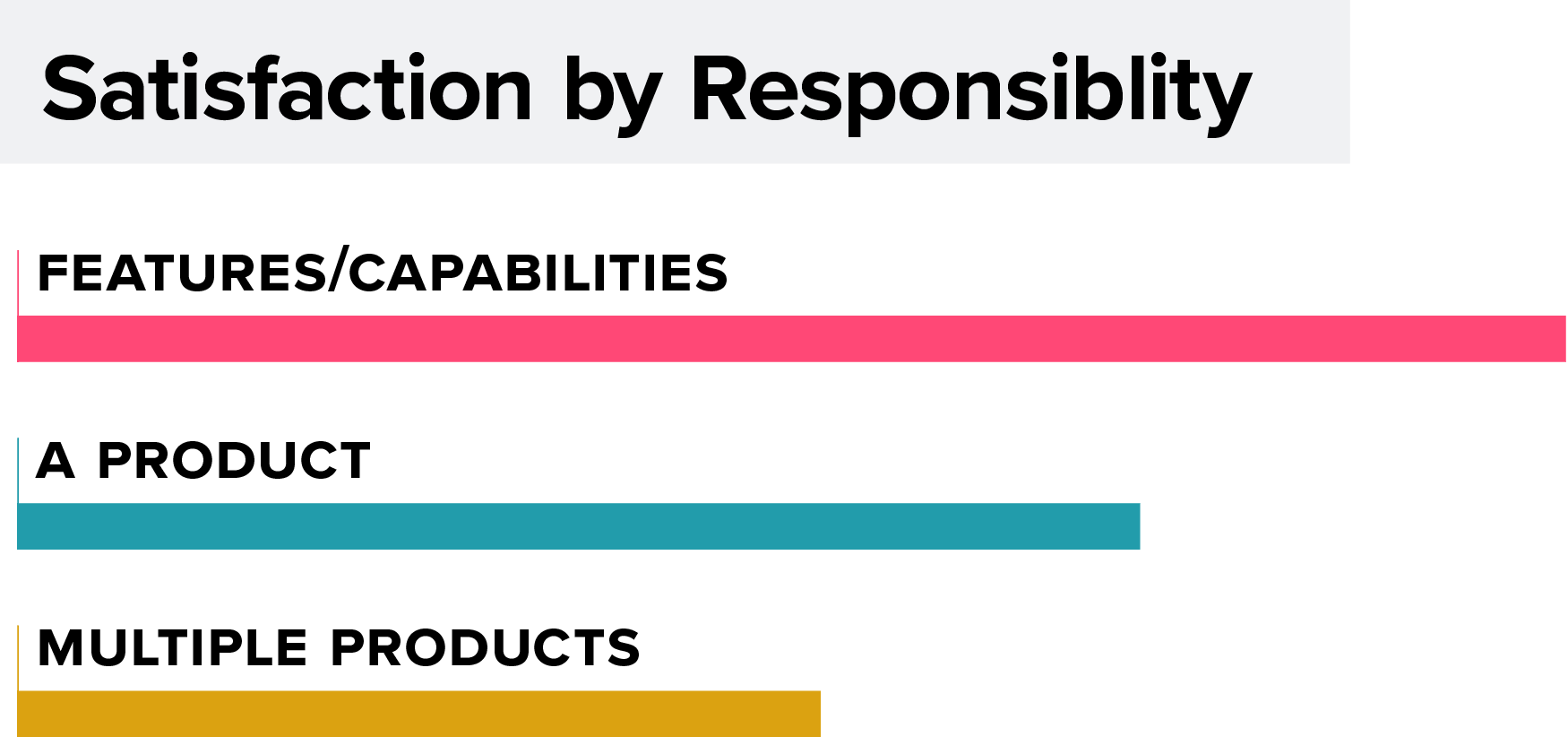

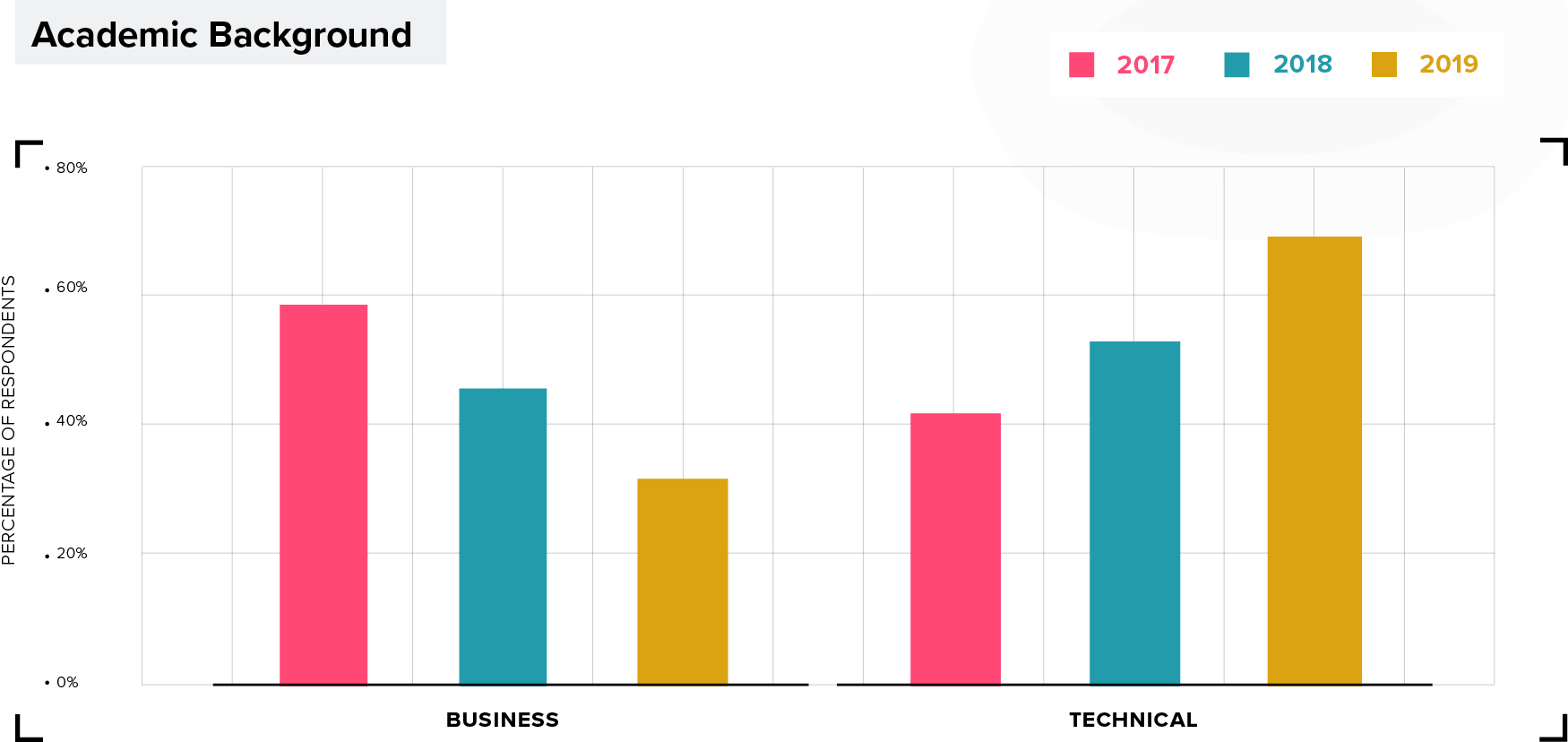

Most often, they have a technical academic background.

Academic Background

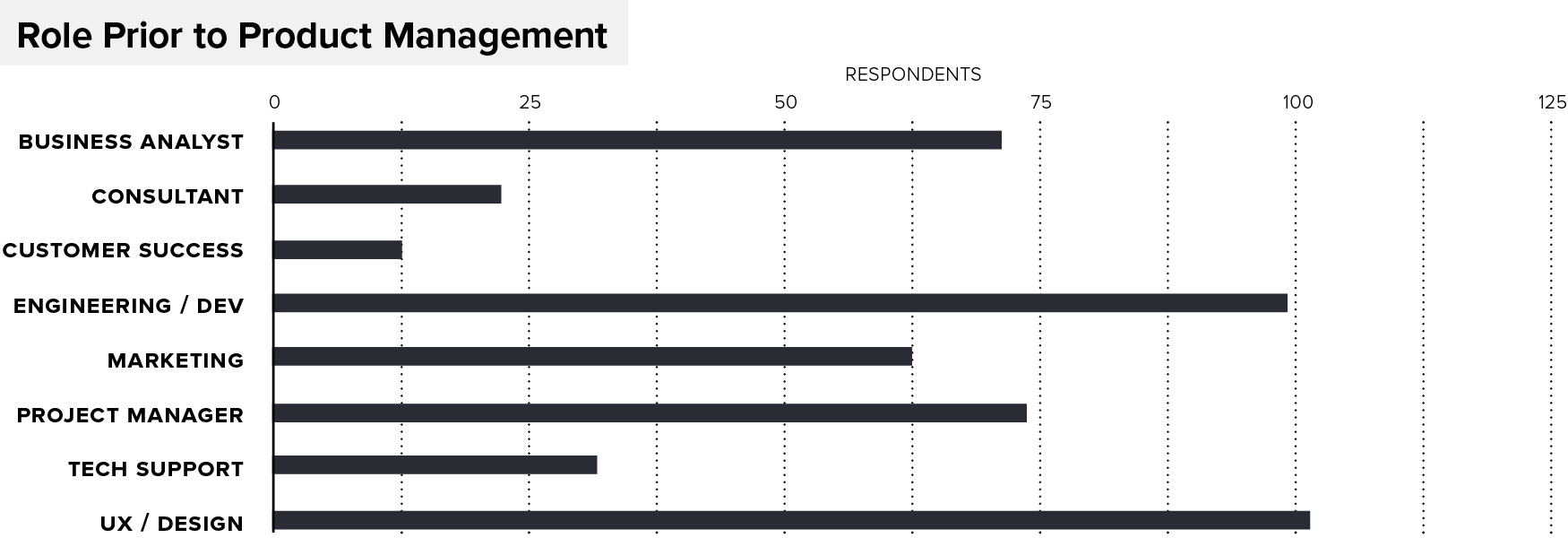

Role Prior to Product Management

They come up through engineering and/or UX.

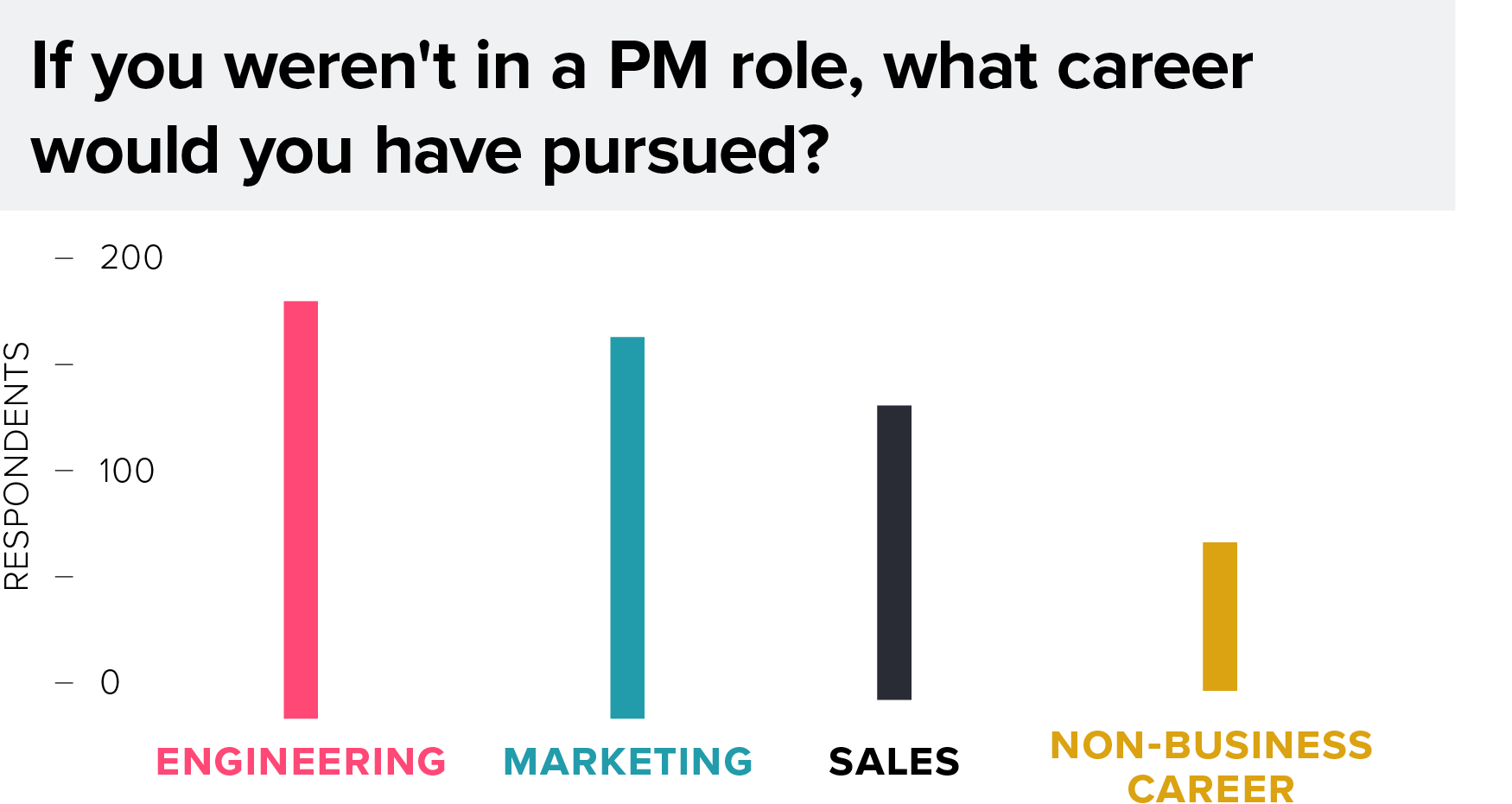

If you weren’t in a PM role, what career would you have pursued?

And, if they weren’t working as product managers, they’d probably be writing code.

With such a clear trend toward technical backgrounds, technical aspirations and technical reporting lines, it makes you wonder whether product management could eventually over-rotate, potentially losing sight of the customer need as they become increasingly focused on the technical implementation. At the very least, it’s something to be mindful of as product leaders.

Finding 4: Leadership

The vast majority of product people see their companies as product led.

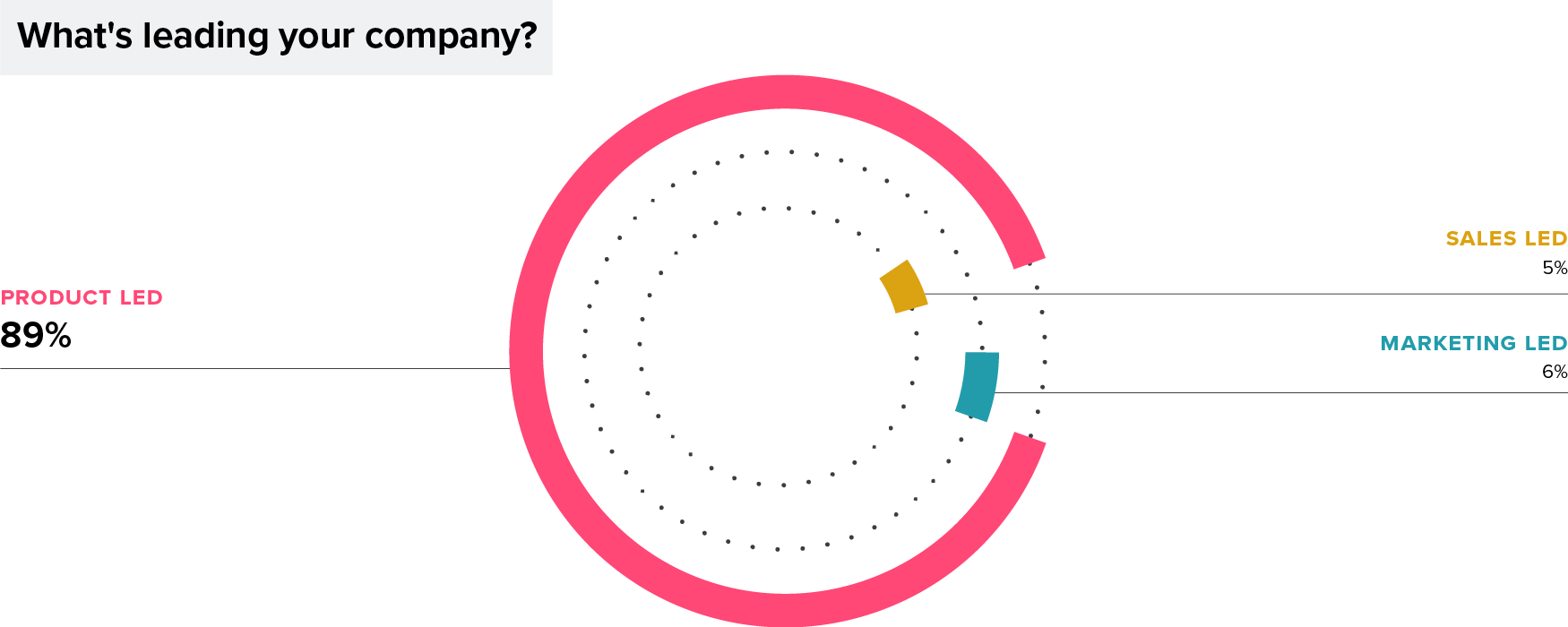

What’s leading your company?

For many companies, business models and the go-to-market motion are becoming product led. What exactly does that mean? It means that the product is one of the first moments of truth on a buying journey, where a trial or freemium offer becomes a first impression. It means that sales and marketing organizations are reorienting to let the product and the positive social proof it generates take the lead, where aggressive sales and marketing tactics take a backseat.

There’s plenty of sample bias in asking any population to rate their own importance, but we thought we ask anyway: Is your company sales, marketing, or product led? There is no great surprise that product people, indeed, see their companies as product led, but the margin is pretty remarkable. Nearly nine in 10 see their companies as product led. Damn right they do.

While virtually every company is now subject to this macro trend, it’s SaaS vendors that are feeling it most acutely. Welcome to the age of product led. There’s no hiding behind a false brand promise. Today, products—in the most literal sense—are expected to do the selling.

Finding 5: Challenges

Product leaders are universally challenged by roadmap prioritization and customer onboarding.

One of the primary jobs of a product manager is to refine a massive universe of possible investment candidates into the few that will have the greatest impact for customers and the business. If there are a hundred features an organization could build, most companies are resourced to invest in a handful. That can feel like an exercise in nearly impossible tradeoffs, where the difference between one bet and another can have enormous but unknowable implications for the customer and company. It can feel like a high-stakes gamble, so it’s no great surprise to hear that product managers still struggle in this area with little differences in company size, company type, and geographic location. Yes, PMs in the UK feel slightly better about their ability to prioritize roadmaps, but nobody is exactly declaring victory in this area.

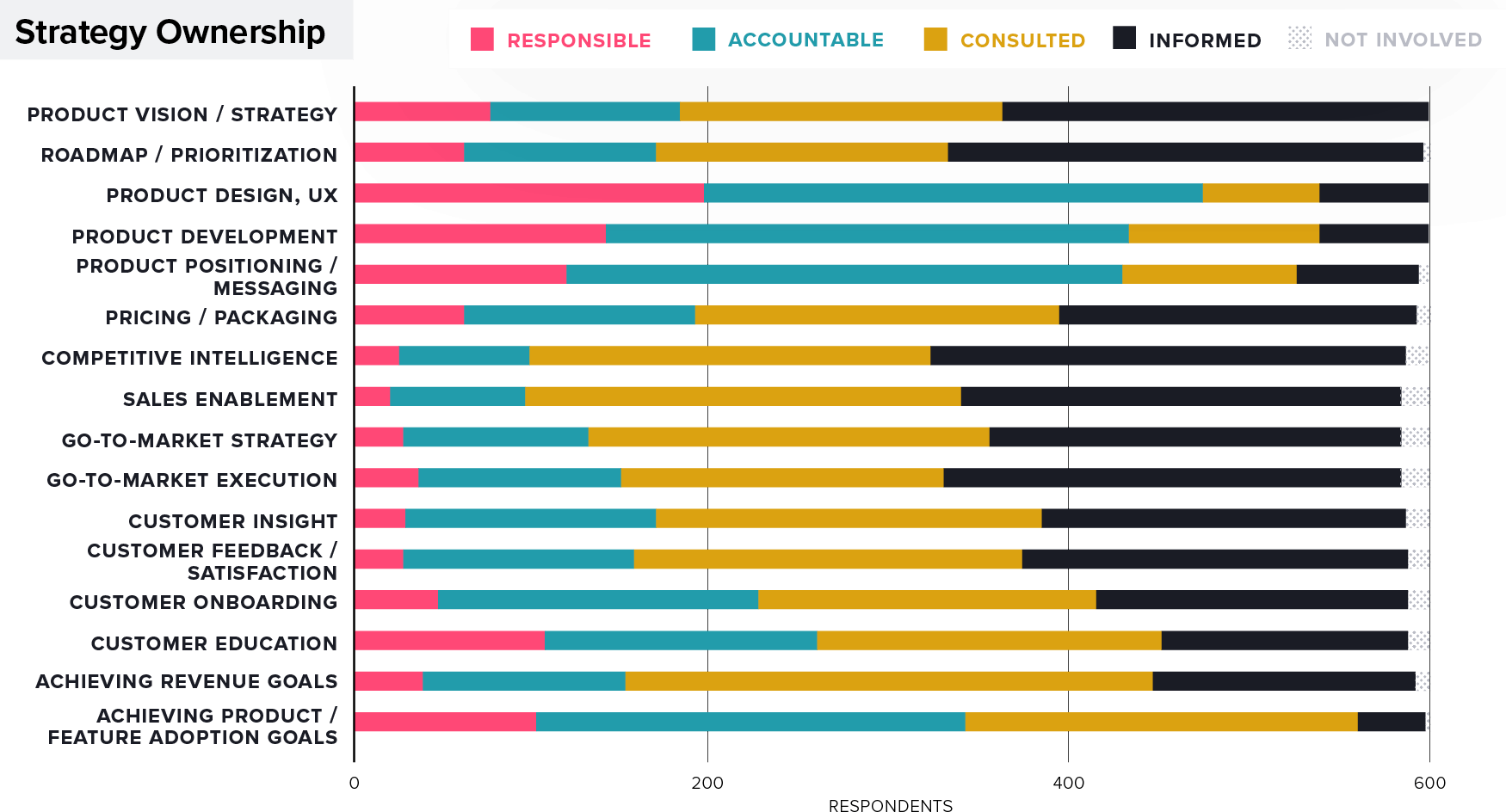

Strategy Ownership

Interestingly, when we asked product managers about the degree of responsibility by function or job, we expected roadmap prioritization to rise to the top. But our respondents told us a different story. They feel this is an area they don’t necessarily own. If you think about it, this could reflect the tricky politics of product roadmaps. In perfect circumstances, product managers would be the final arbiter of authority on roadmap decisions. Of course, that’s not always the case. Product managers need to synthesize many voices, some louder, more influential and insistent than others. Decisions are often subject to the HiPPO–the highest paid person’s opinion (the CPO, the CEO, etc.). Ultimately, product managers don’t feel wholly in control of where their product is heading. We saw a slight increase in confidence over last year, but roadmap prioritization remains an area that ranks toward the bottom in overall performance this year.

Another key function faces a similar challenge: customer onboarding ranks toward the bottom in performance, and it is also a function for which product managers feel accountable more than they feel responsible. This could indicate an uncomfortable dependency on the customer success team for completing these onboarding tasks (more on this with Finding #7 on alignment challenges). When you consider the fact that product teams increasingly measure their success on the basis of product usage and feature adoption (see Finding #10), it’s no surprise that product teams might feel frustrated that this is an area where they can’t control certain outcomes that they depend upon in the successful prosecution of their own roles.

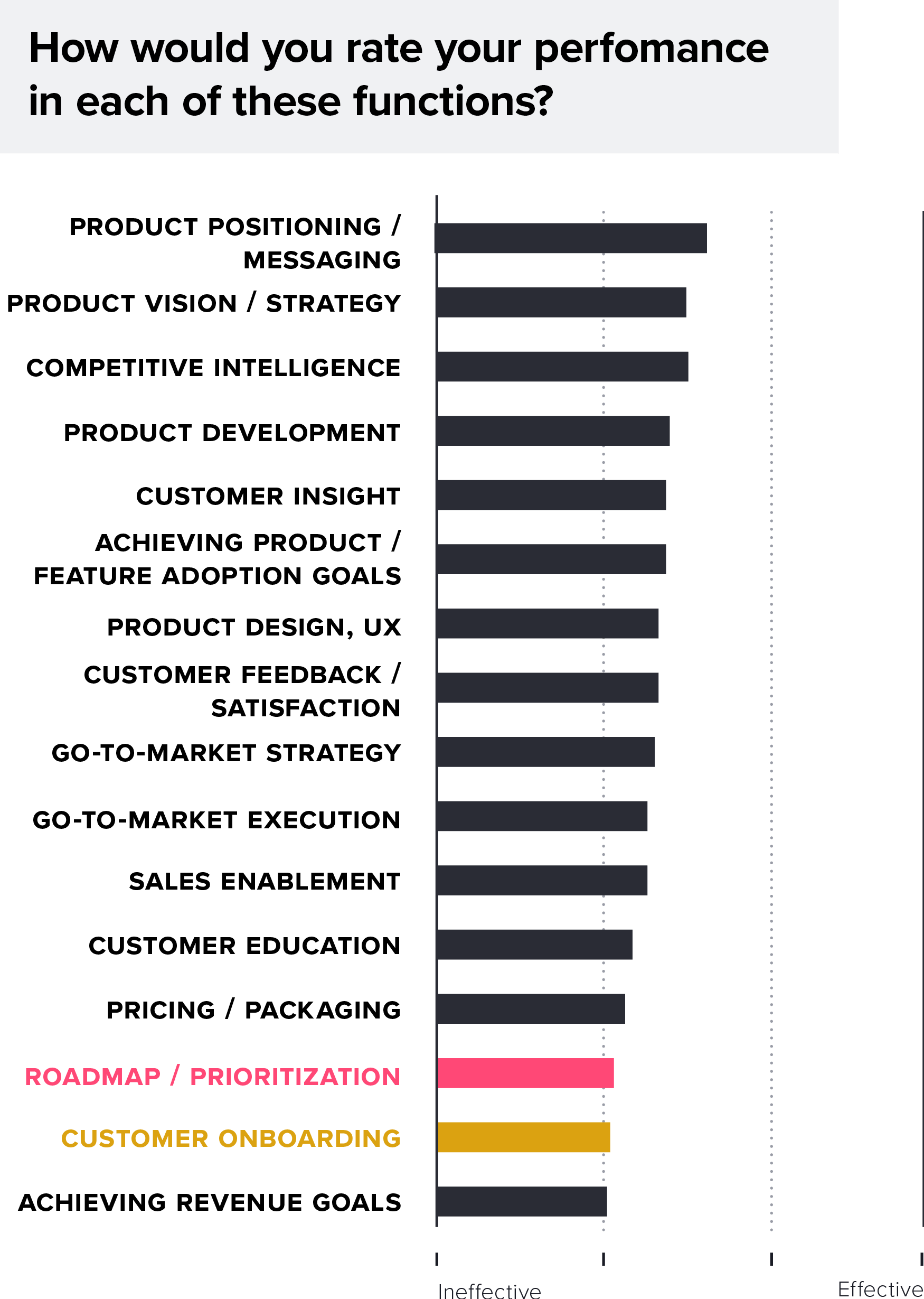

How would you rate your performance in each of these functions?

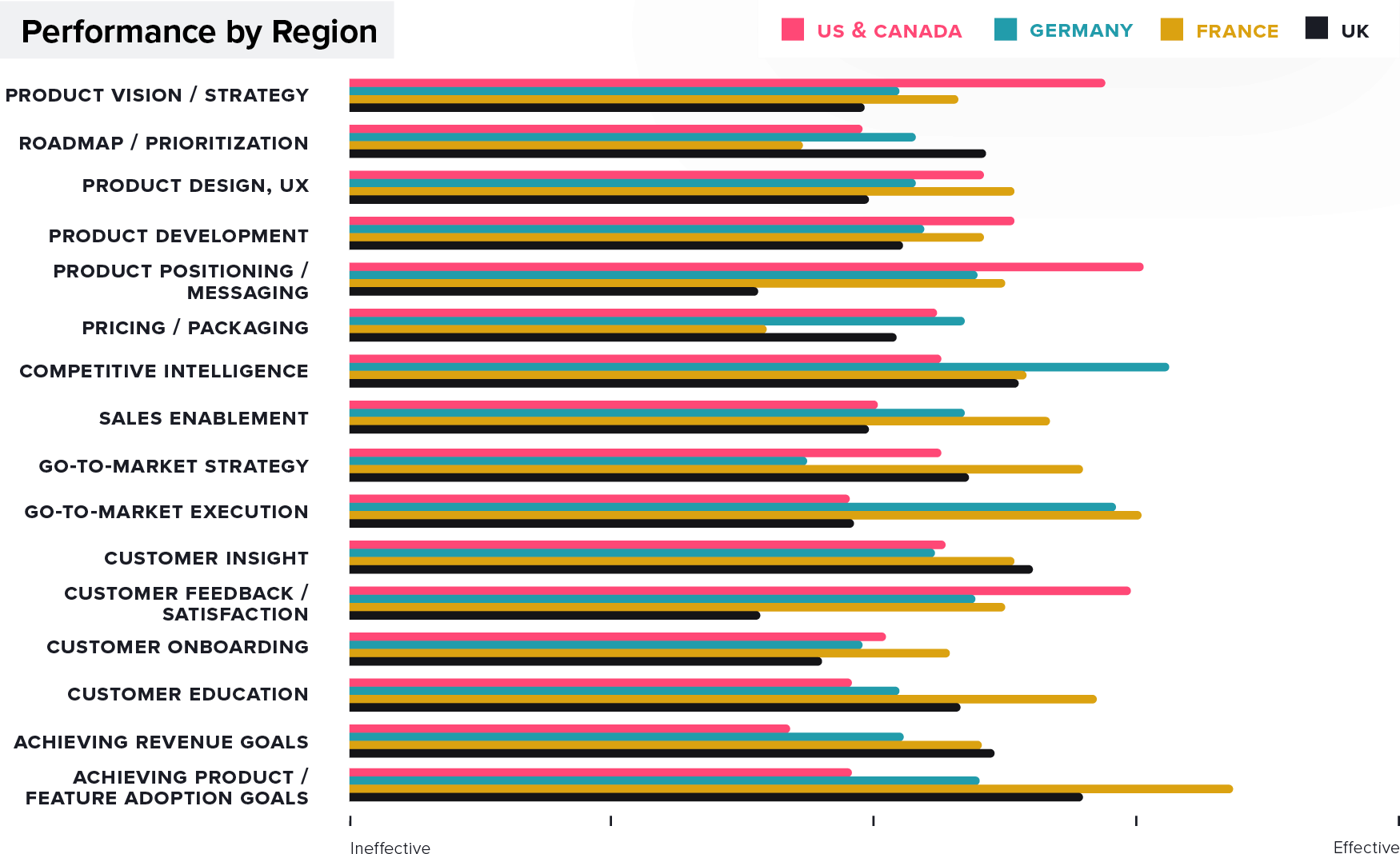

There are also some interesting regional differences in these overall performance assessments which may be explained culturally. Generally speaking, US & Canadian product managers see themselves as more adept at functions that are strategic in nature (e.g., product vision/strategy, product positioning/messaging, customer feedback/satisfaction), and less so in more tactical and operational functions (e.g., go-to-market execution, achieving product/feature adoption goals). In many of these more operational functions, we see European counterparts—French and German PMs, in particular—telegraphing higher degrees of confidence in their capabilities.

Performance by Region

Finding 6: Tactical or Visionary

Product managers see themselves as more tactical than visionary—and believe this orientation is well aligned with what their organization hires for and values most.

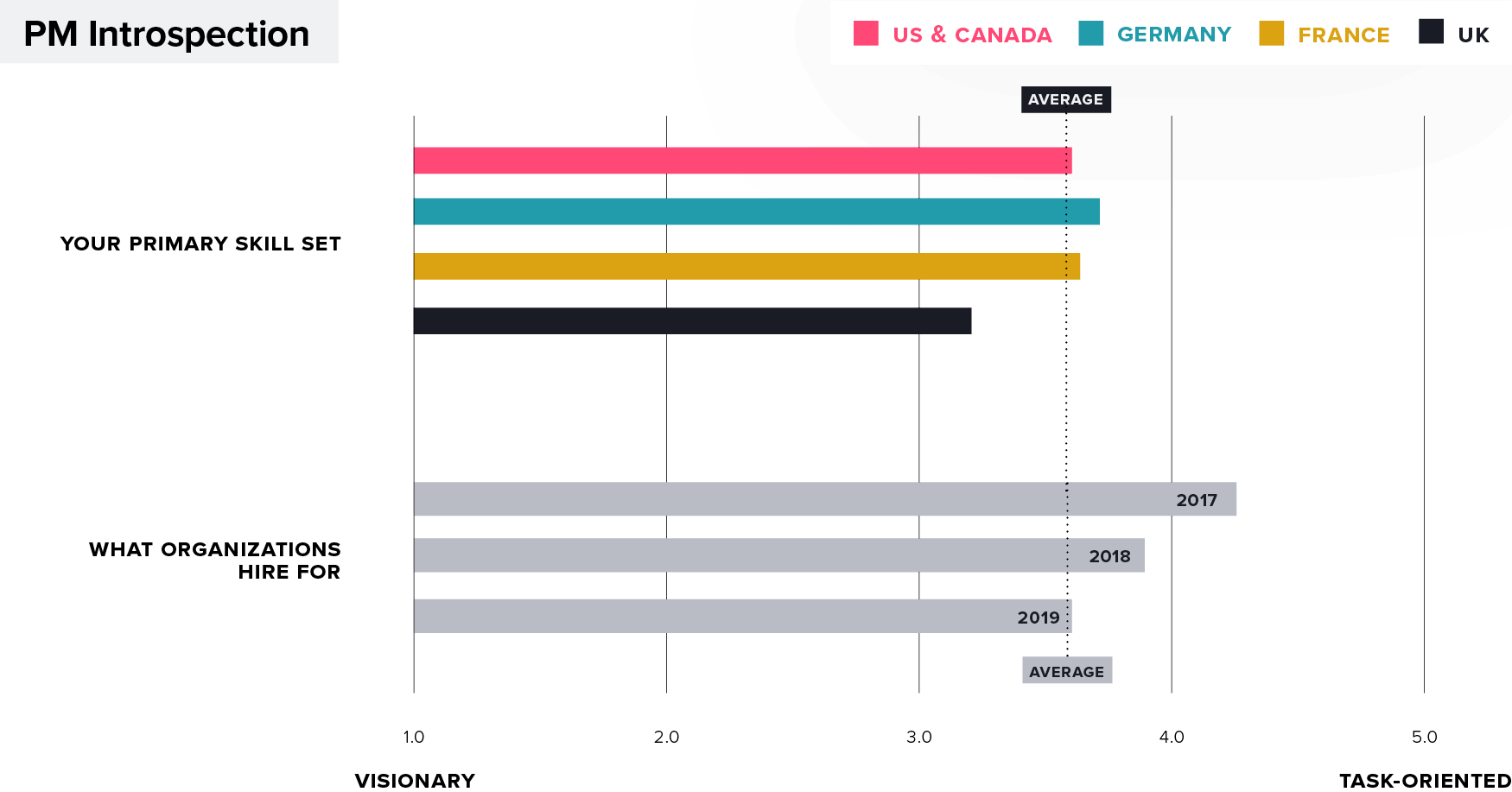

Product managers are expected to set a compelling vision for a product and execute on that vision with aplomb. But rare is the individual who can do both of these things equally well. Each year, we check in on product leaders’ view of how they see themselves on a continuum of visionary to tactical, how this squares with how their company hires PMs and, importantly, which orientation their organization values most. Variation was minimal across geographies, with the exception of UK product managers who see themselves slightly more visionary than their counterparts.

PM Introspection

We asked product managers how they see themselves

The results confirmed a trend we’ve seen since the inception of this survey: product managers see themselves as more tactical than visionary and they believe this orientation is well aligned with what the role is all about. More tactically oriented PMs are also happier on average, reporting an NPS score five points higher than their visionary counterparts. Product management is a challenging, often harried role.

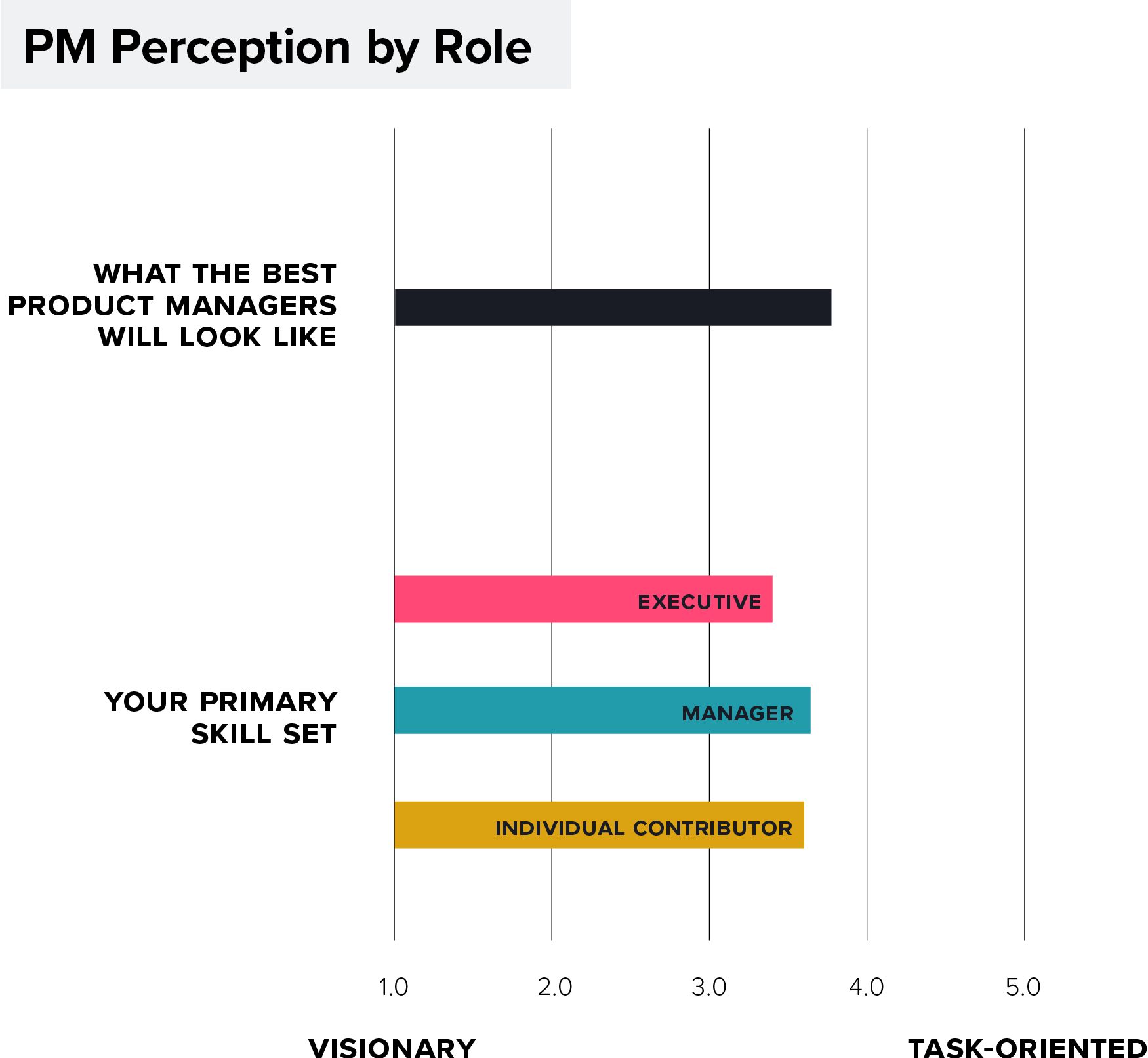

PM Perception by Role

NPS Scores

While we may romanticize product managers as gazing off into the middle distance while pondering a better future for their customers, the reality is that there’s a lot of detail to manage and busy work to get done. The rare Jobsian hero who can see around corners and anticipate unarticulated customer desires is just that: rare. Product management is about the hard work of doing research, synthesizing data, and socializing and communicating product directions. Hardly glamorous, but important work nonetheless.

Finding 7: Alignment

Product leaders feel dependent on close alignment with the customer success function, but worry that there’s still weakness in this relationship.

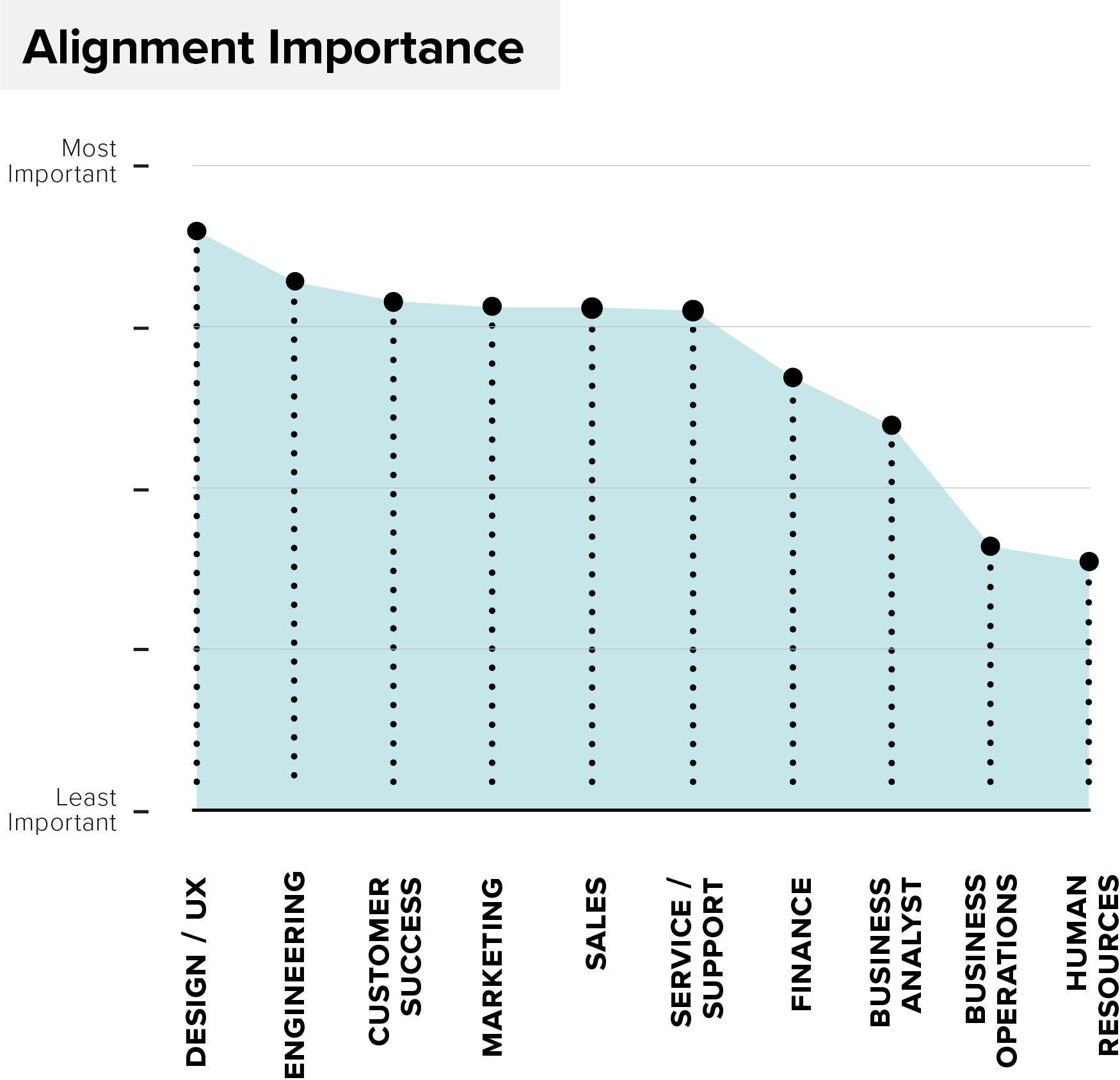

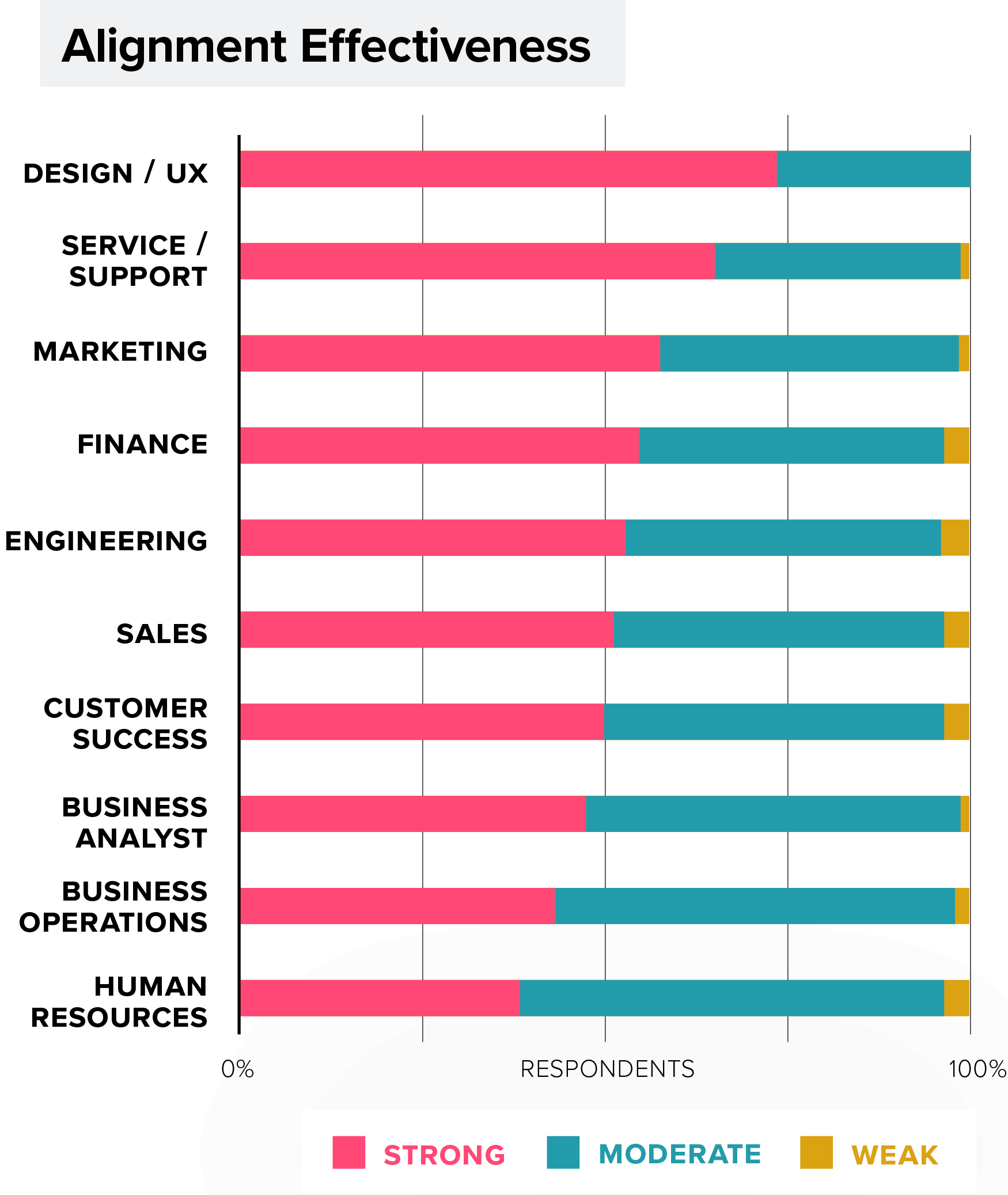

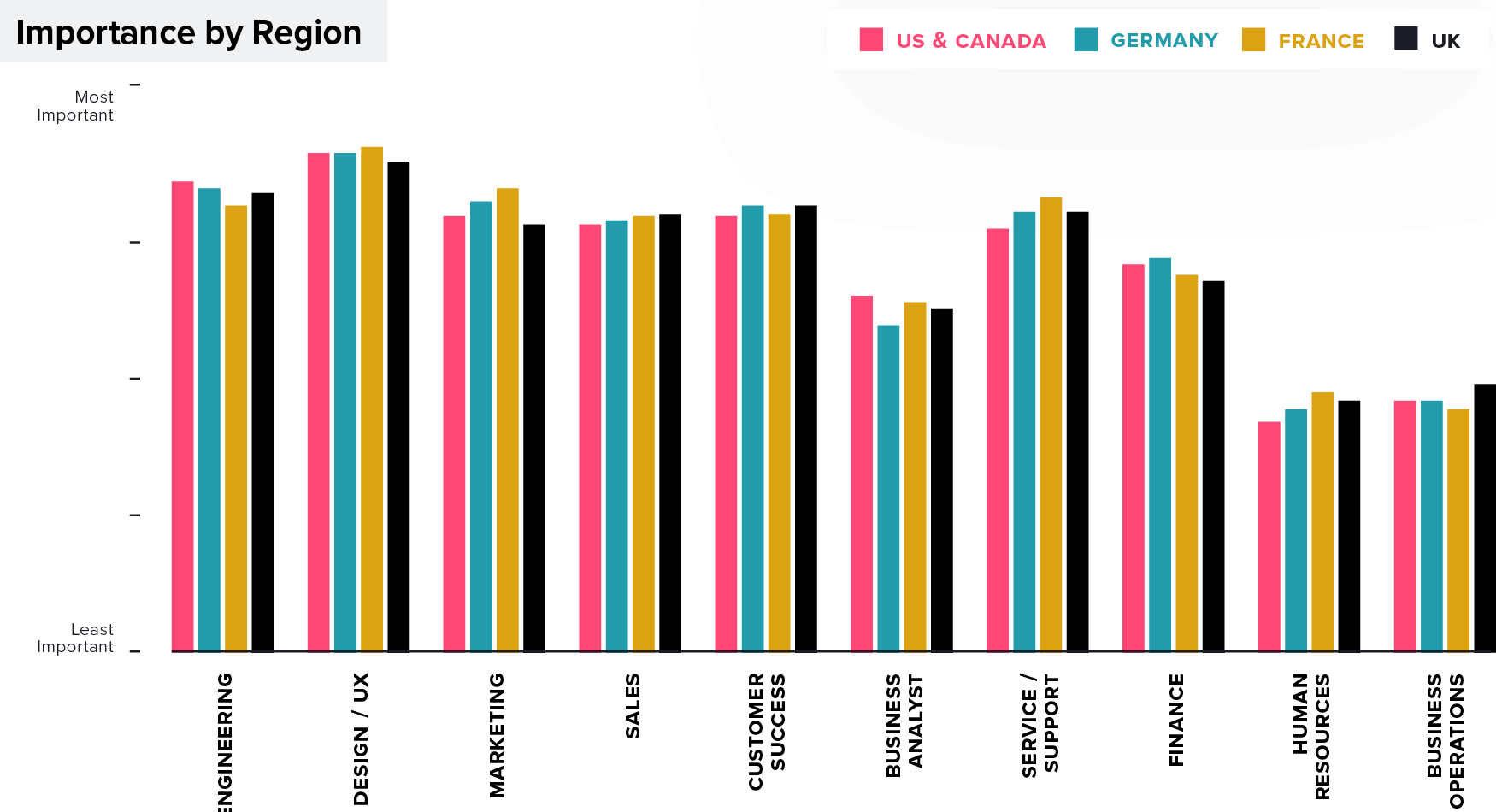

Last year, product leaders told us they worry a bit about their alignment with the customer success team, which they saw as an important relationship and one with plenty of room for improvement. The findings this year confirm this sentiment. Aside from engineering and UX, which are core internal constituents to a product manager, sales, marketing, customer success, and support are seen as the most important adjacent functions. When we asked product leaders about the effectiveness of their alignment with these functions, they signaled relative confidence in engineering, UX, and marketing relationships, but revealed a less rosy picture for sales and customer success.

Alignment Importance

Alignment Effectiveness

The source of misalignment with sales is well documented: from time to time, salespeople will overpromise on roadmaps, putting product managers in the uncomfortable position of either rearranging priorities or walking back a commitment. The source of misalignment with customer success is a bit more complicated. As the owner of the post-sales customer relationship, customer success is the primary interface between the product team and the customer. While this brings a necessary and important coordination function to customer communications, it also adds friction—friction in what gets communicated out to customers and what gets captured and communicated back to product teams. This can have implications for customer onboarding, feature adoption and product usage, and capturing feedback to inform roadmaps–all core jobs for the product manager, but often intermediated by the customer success team.

Importance by Region

Finding 8: Product Ops

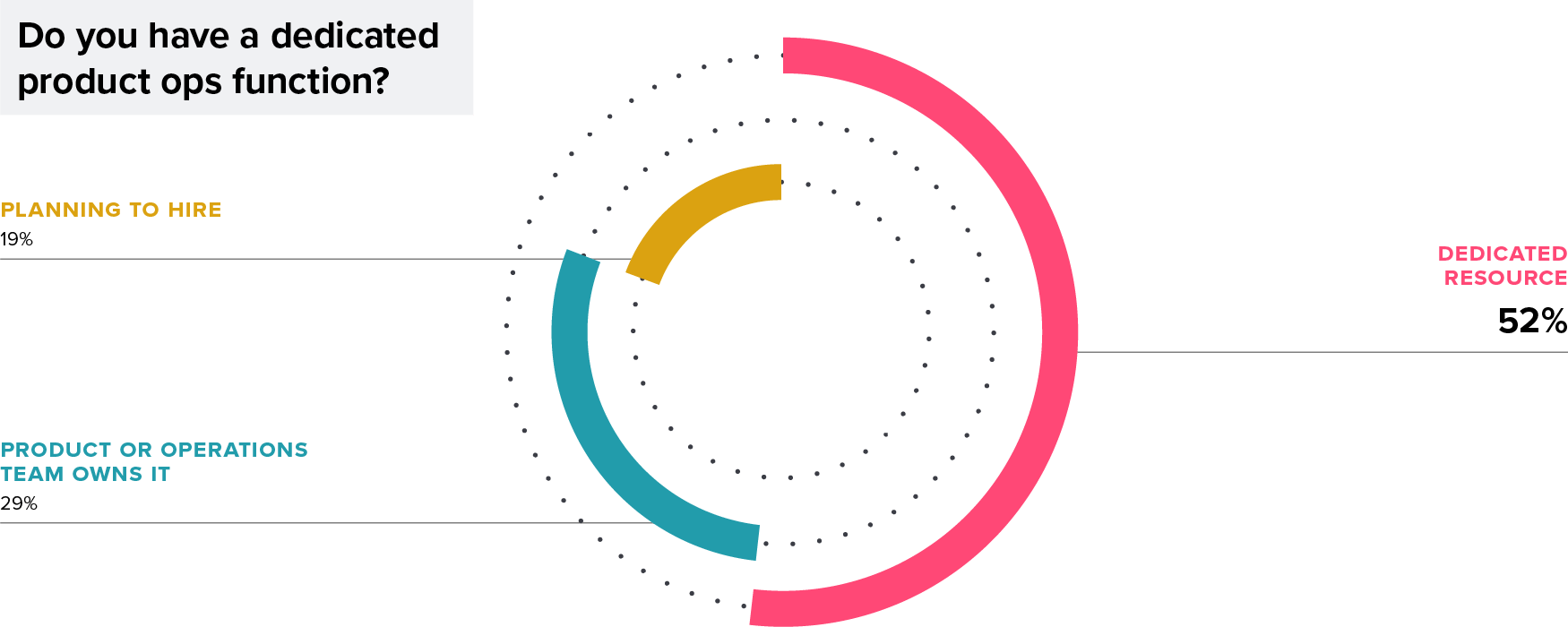

More than half of product teams now have a dedicated product ops function.

Do you have a dedicated product ops function?

SaaS has brought the product manager fundamentally closer to the customer by providing visibility into how products are adopted and used and providing ways to capture new insights and shape behavior inside the product. But this has also made the role more data-intensive and operationally focused than ever before. Our survey shows that more than half of product teams now have a dedicated product operations function to wrangle data in support of better product decisions; to coordinate internal and external launches and communications; and to orchestrate the right messages and experiences inside the product. In addition to the 52% who have already built this function, another 19% have plans in the works to build up this capability. Fewer than 30% of teams expect product operations to remain a shared responsibility. Perhaps unsurprisingly, the data shows a strong correlation between company size and the presence of a standalone product ops function, with 96% of companies over $1b in revenue reporting the presence of a dedicated product ops resource compared with just 17% under $25m in revenue.

Finding 9: Decision and Insights

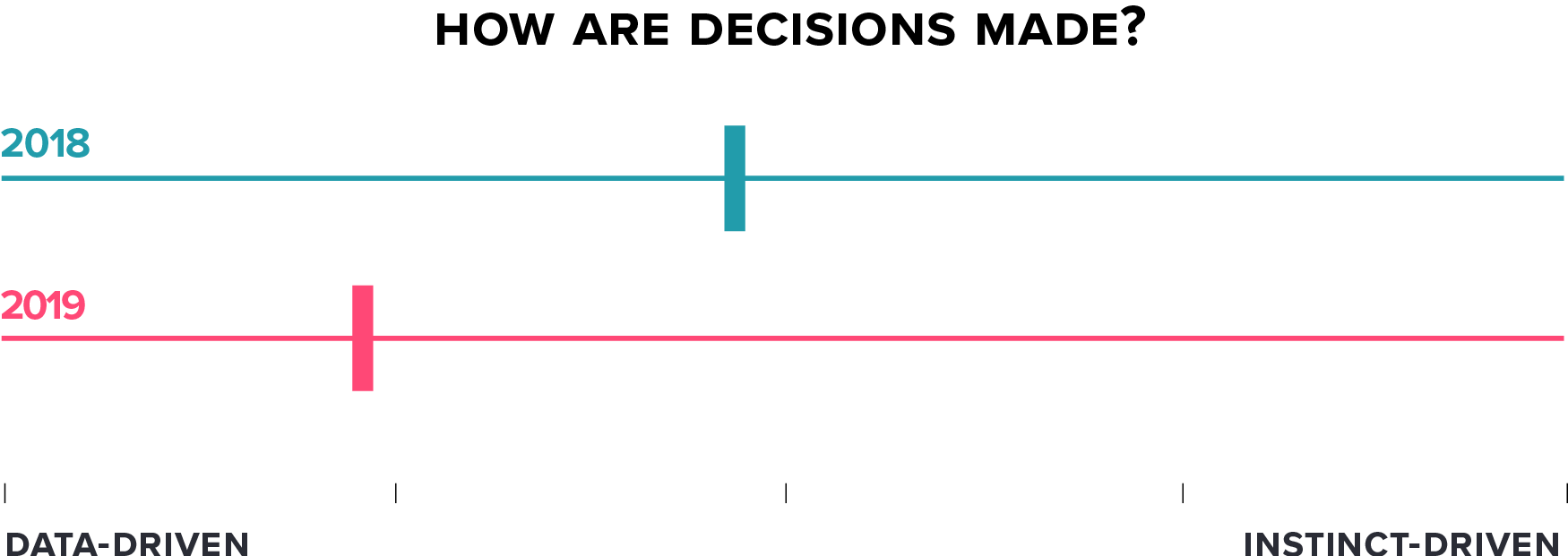

Product leaders see themselves as highly data-driven, with a holistic view of customer and market insight.

Data-driven is now an unnecessary modifier for virtually every business function, product management certainly to no lesser degree. Each year, our data reveals a role that’s increasingly dependent on troves of customer data and market insight. Unsurprisingly, therefore, product managers see their decision making process as much more reliant on data than instinct.

comment les décisions sont-elles prises ?

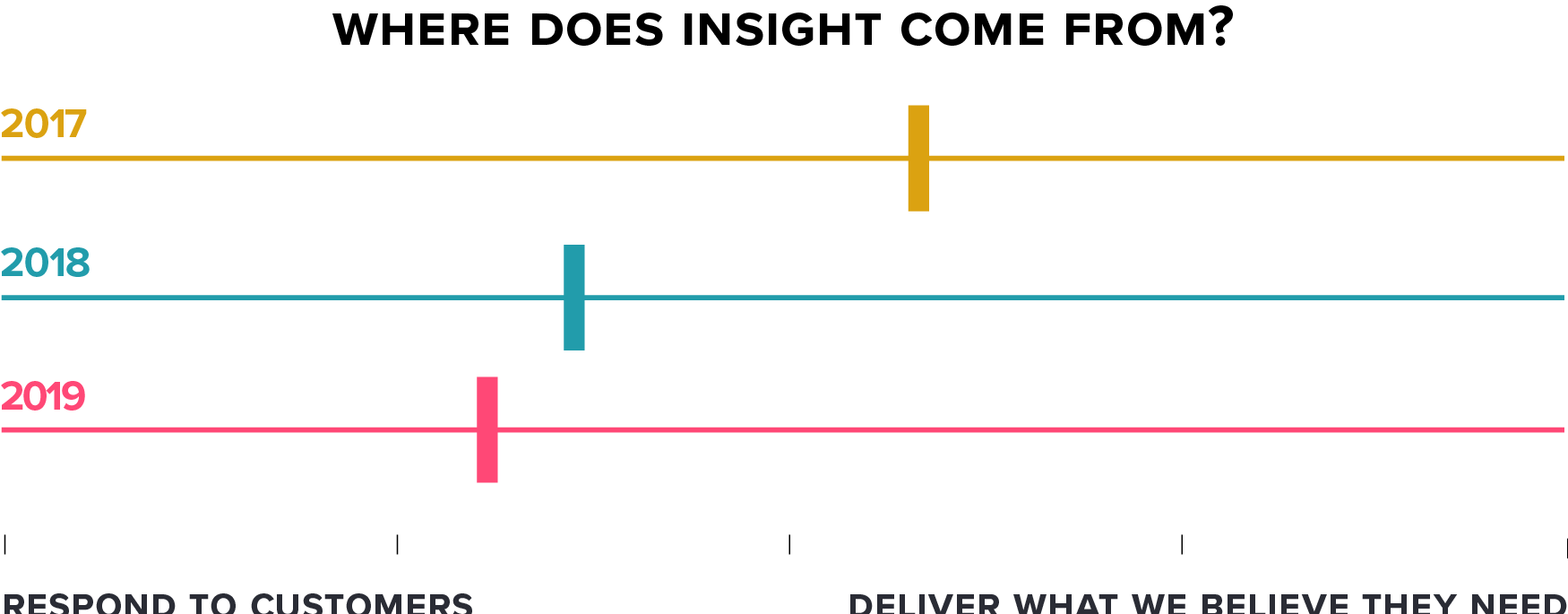

Where does insight come from?

There’s an old trope that true innovators don’t ask customers what they want because customers wouldn’t know what they need—or wouldn’t have the words to describe it. Our data suggests that product managers buck this tradition, making decisions based on what customers explicitly ask for more so than what PMs presume they need. While there’s probably some degree of truth to the old trope, treating it as doctrine will likely backfire by alienating customers who expect to be heard and minimizing the important insights they have to share.

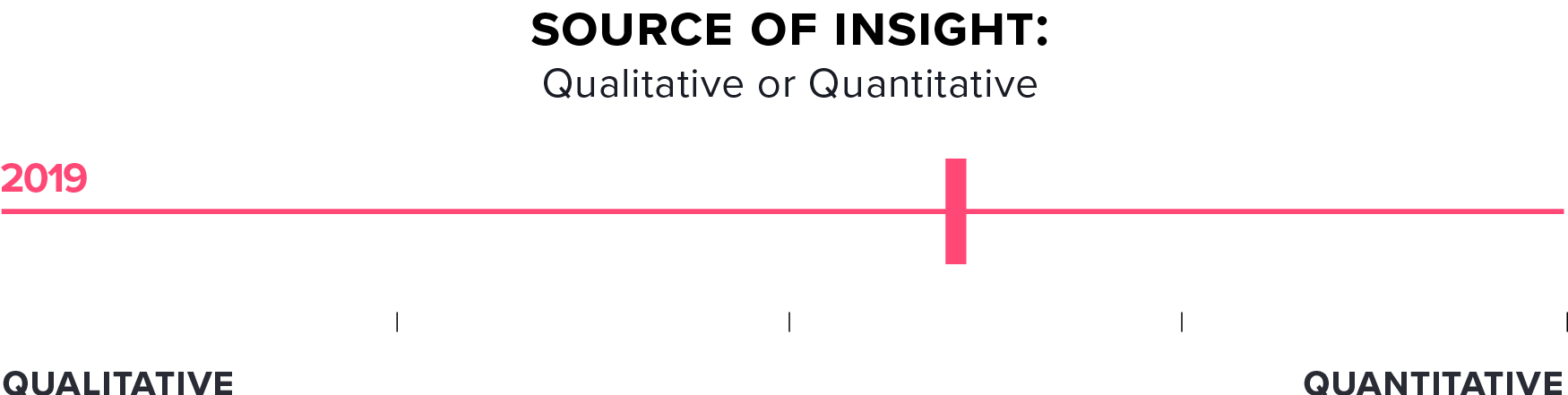

Source of insight: Qualitative or Quantitative

Similarly, the most valuable insights are often found at the intersection of what customers tell you explicitly and what they demonstrate through their behavior. It was equally encouraging to see that product teams had achieved balance in collecting reported and observed data.

Source of insight: Reported or Observed Data

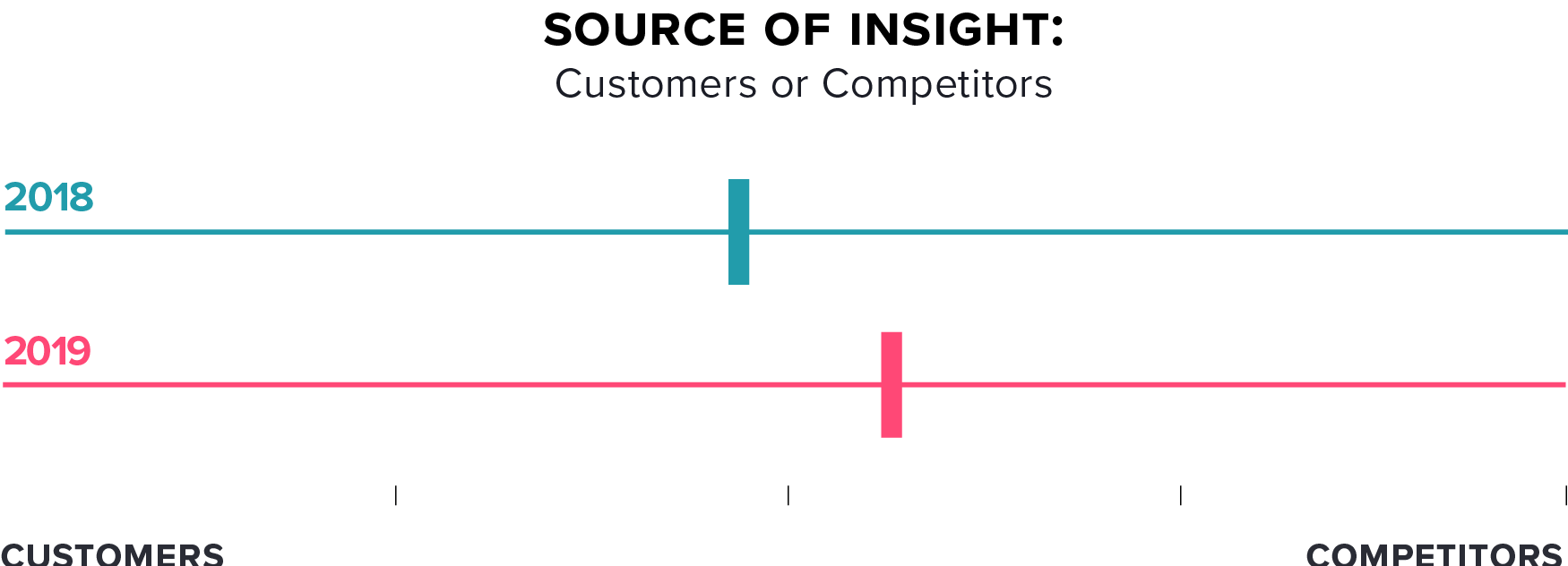

Source of insight: Customers or Competitors

In competitive markets, it’s easy to find yourself looking over your shoulder at what competitors are doing. This sort of insight is important, of course, but it can become the source of regressive thinking and a major distraction from the important work of solving for a customer pain. Besides, it’s much harder to win a race by matching a competitor move for move. We asked product leaders what drives their decisions—customers or competitors. Again, we saw an equal balance between the two. But unlike the other questions, we’d prefer to see this one a bit less balanced, with a marked bias toward the customer, as we saw in last year’s survey.

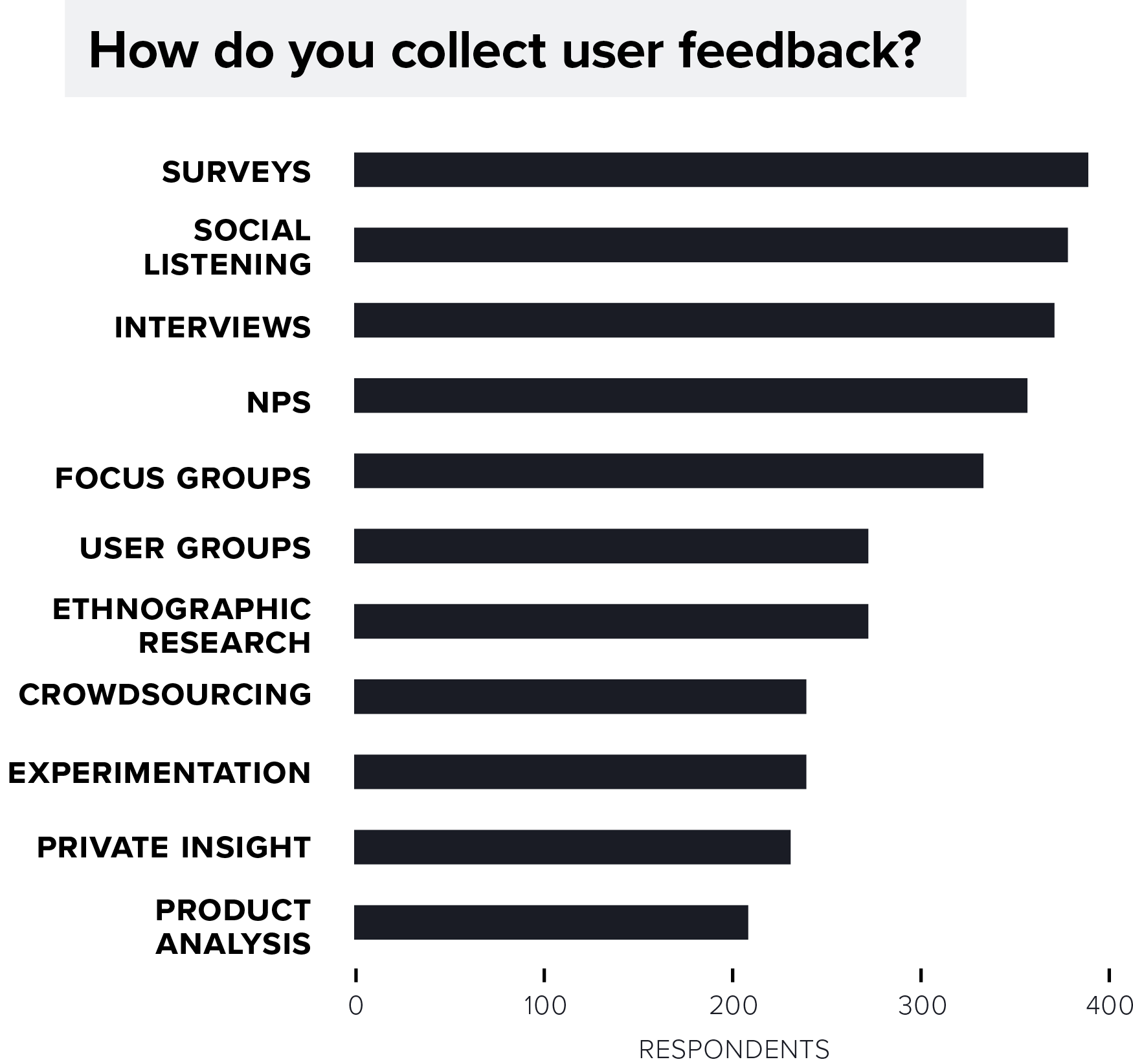

How do product teams collect customer input? Surveys, social listening, and interviews were the top three techniques cited this year. Surveys, it’s worth noting, can become a bit of a crutch because they’re relatively easy to execute at scale. But in doing so, a lot of nuance and fidelity may be lost. Ideally, surveys are used in conjunction with—and never a replacement for—direct customer interviews. Most worrisome here is the fact that experimentation ranks near the bottom of the list. Running frequent experiments should be a key aspect of every PM’s role.

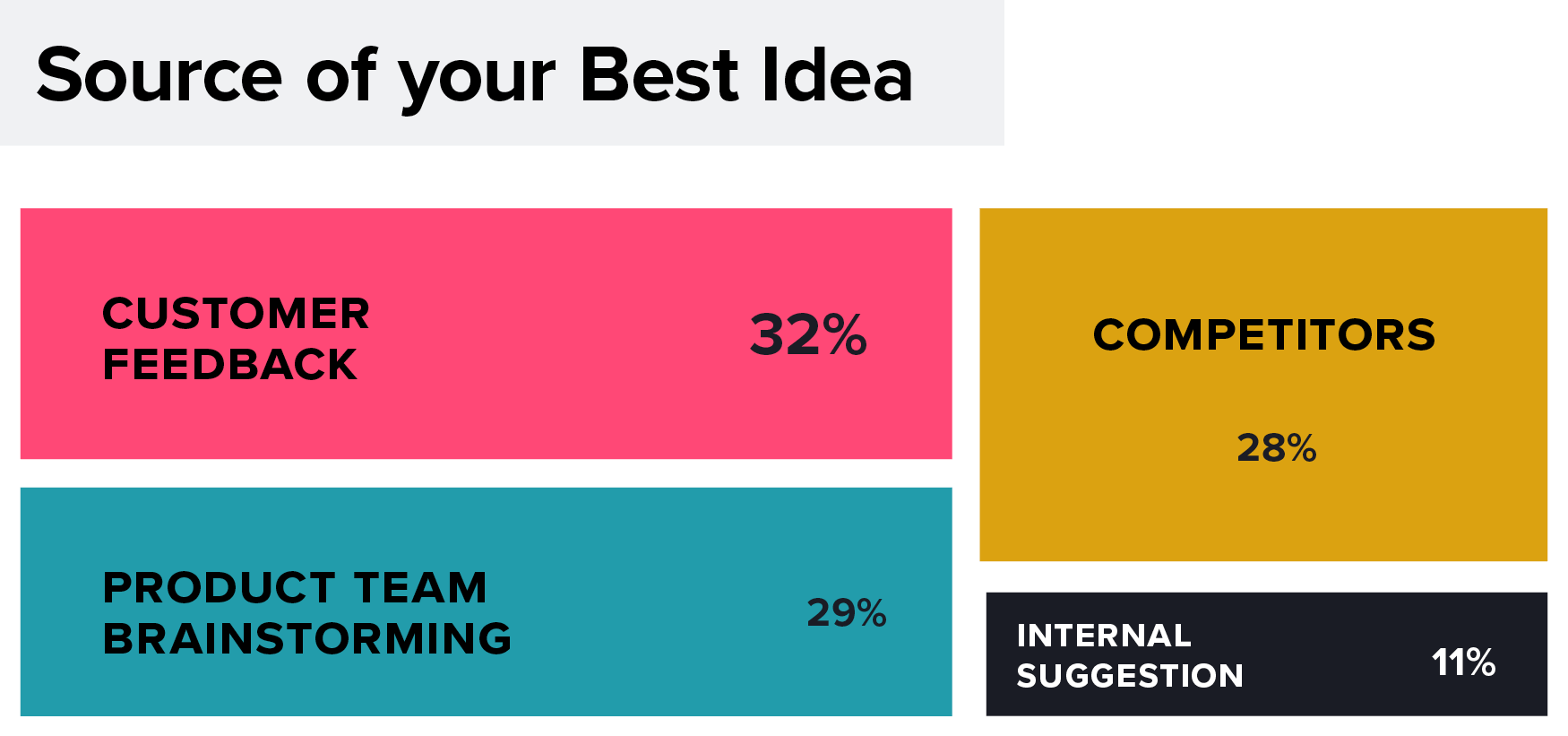

Source of your Best Idea

How do you collect user feedback?

We also asked: what was the source of your best product or feature idea last year? Again, competitors are a bit too prominent in this mix—last year, we saw less of a focus on competition when we asked this same question—but it’s heartening to see such a strong focus on customer feedback. It should also be noted that all of this focus on data and customer feedback shouldn’t overshadow the important human element of instinct, intuition, and expert judgement. Of course, you’d expect data to play a role here, too, but the singular magic of collaborative ideation comes from smart, passionate teams putting their heads together to brainstorm and problem-solve. Much like last year, roughly 30% of the best product ideas were said to come from these efforts.

Finding 10: Measurement

Product usage and feature adoption are now the north star measures of product success.

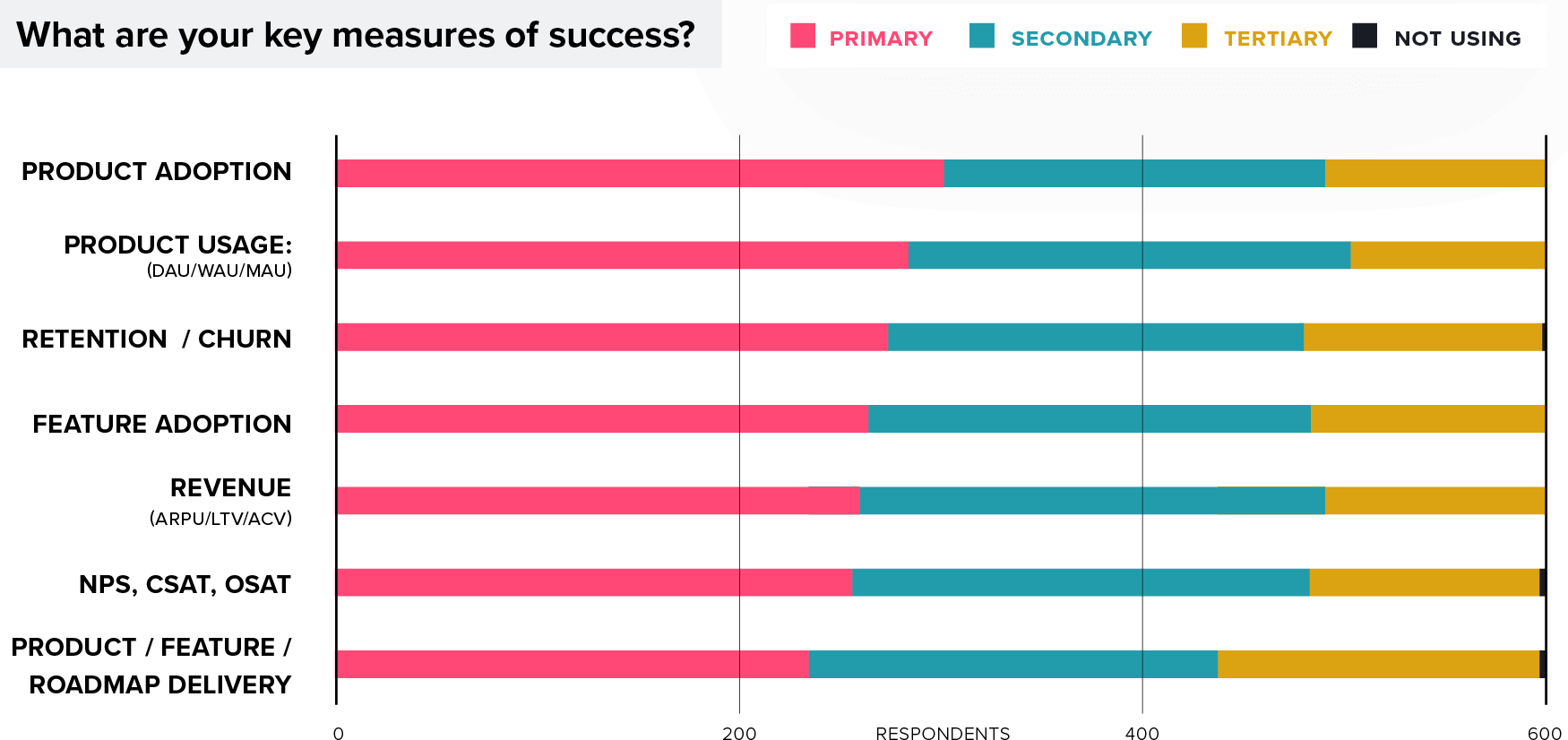

What are your key measures of success?

It was with something like mild horror that we reported last year that, more than any other metric, product teams counted number of features shipped as the key measure of their performance. We subsequently spent the better part of the year reminding whomever would listen that this was a flawed and outmoded way of thinking. So it was gratifying to see product teams cite feature deliver at the least important measure of their performance. Hallelujah.

So what was the top measure of product team performance? Product adoption and usage edged out even revenue as the north star measure of product team success. Ultimately, what product teams deliver is only as valuable as what’s adopted by customers—and customers that adopt and regularly use products are the ones that tend to become loyalists and advocates. So it makes sense that adoption and usage would rise to the top of the list. This feels like progress.

Recommendations

1. Review reporting lines

The majority of product teams now report into a CPO, which has a positive impact on organizational influence (if not PM happiness). Where does product report within your company? There was a time when most product teams reported into marketing. Today, that seems to be the rare exception. Revisit your org charts. Don’t create change out of fad or fashion, but be sure your reporting lines align with your product goals and objectives.

2. Get your roadmaps in order

Prioritizing where and when to place bets is a key role for product managers, but this survey suggests that product teams feel a bit out of control in this area. Remember to bring data to make your case for roadmap investments—because, in its absence, prioritization decisions will inevitably default to the HiPPO (the highest paid person’s opinion). Arm yourself to make the right moves for the company and the customer.

3. Set adoption goals and create a plan to achieve them

Product usage and adoption are now the north star metrics for product teams. But how do you measure these things—and, crucially, ensure you hit your goals? It starts with data, of course, to understand adoption patterns. But it also requires close collaboration with other stakeholders—customer success, professional services, training, support—to ensure customers are properly onboarded and educated and empowered to build lasting habits inside your products.

4. Elevate your self-education

For product people looking to elevate themselves in managerial/executive product roles, it’s important to continue to learn. Seeking out advanced product education can give you a much better chance at breaking out of the individual contributor product role.

5. Create a path to product ops

There’s more data, more coordination, more moving parts, and more change in the product management function than ever before. To handle all of this, over half of companies now have a dedicated product ops function in place. Those that don’t may be overwhelming PMs with jobs they’re not well suited to—or, more importantly, distracting them from the core job of building a differentiated product and solving high-value customer pains. If you don’t have a plan for product ops, make one. Your team will appreciate the support.

Want to learn more about Product Ops?

Stripe, Uber, Insight Partners, Comcast, and others share how they approach product operations in their organizations.