Institutions financières : 6 façons d'améliorer leur expérience numérique

Table des matières

In a rush?

Download the PDF for later

As businesses temporarily close physical storefronts, they’re left with the challenge to support and engage with customers digitally. For financial institutions like banks, insurance providers, and wealth management companies, the stakes are at an all-time high: today’s economic climate has impacted customers’ financial situations in entirely new ways, causing an urgent shift in their needs from providers.

When the only door to your business is a digital one, it’s even more crucial that the customer experience you’re providing not only meets what they would’ve had in person, but exceeds it by offering tools that support customers’ changing needs. A McKinsey report from April recommends banks focus on driving adoption of their digital platforms in the wake of COVID-19, citing that usage of these tools increases customer satisfaction and efficiency — two primary concerns of financial institutions today.

To help financial companies optimize their digital experience, here are six tactics we recommend:

1. Automate (and personalize) user experiences

Historically, financial institutions have invested in customer data to evaluate channel effectiveness — today, that is no longer enough. By leveraging data on customers’ interactions with your application (e.g. product usage data, sentiment, and feedback), you can provide a more personalized user experience and encourage behaviors that lead to success — both for the company and the customer.

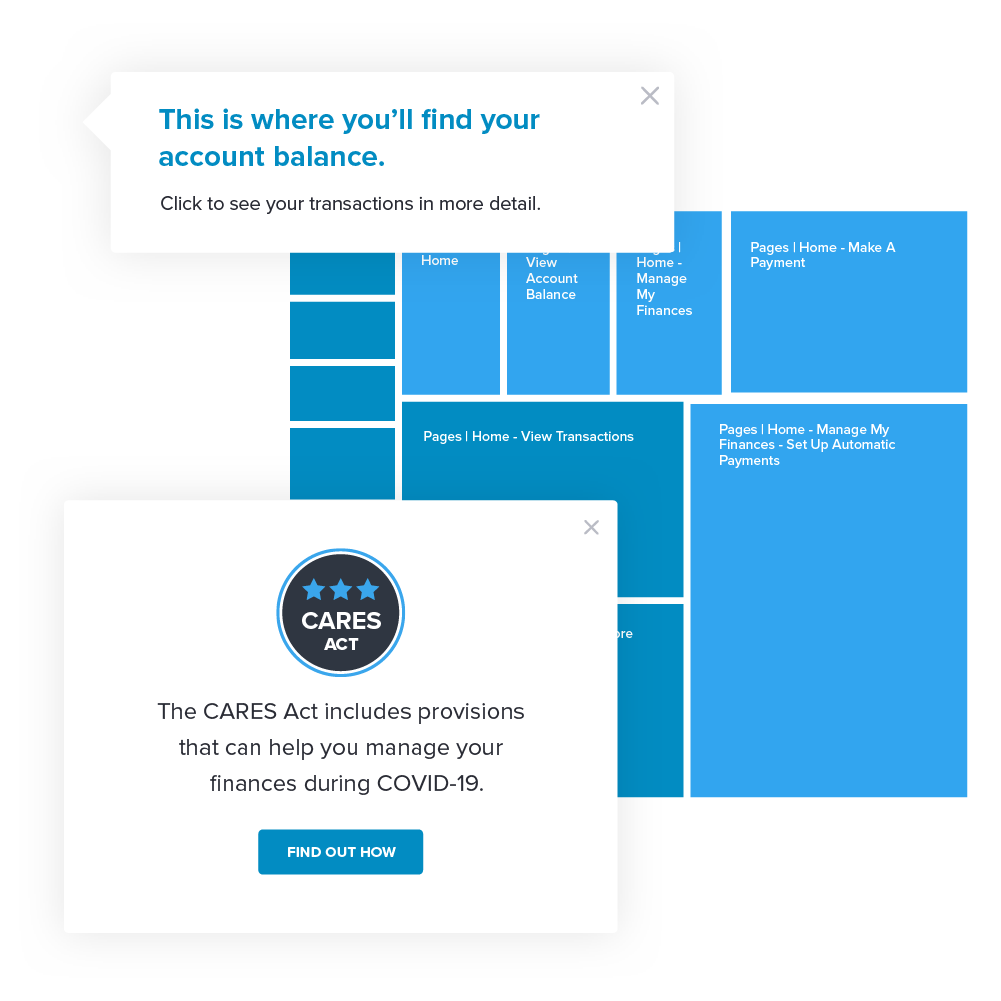

This can be extremely powerful, for example when a bank is able to understand which actions in their platform lead to customer retention. In this case, the team might learn that when a new customer opens a checking account, if they deposit money within two days, set up online bill payments within 30 days, and order paper checks within 60 days, they will keep that customer 90 percent of the time. From there, the bank can set up automated in-app notifications and walkthroughs to guide new users to these key actions, and tailor messaging based on a customer’s account type, services they’ve purchased, and behavior in the application so far.

2. Streamline customer communications

When customers aren’t able to visit their bank or insurance provider in person, there’s even more pressure to deliver clear and effective communication digitally. Not to mention that for many people, this pandemic has proven that things usually done in person can be done online, and they may choose to keep it that way even as brick and mortar businesses open back up.

As a financial services provider, you need to make sure customers feel both supported by and informed of the digital offerings available to them. By moving these communications in-app, you’re able to reach customers when the information you’re providing is most relevant to them. You should also think about how to make these resources easily accessible, for example by providing a central place where messages live in the form of a “Resource Center” or guide library inside the app.

3. Improve internal efficiency with in-app training

While you’re likely focused on ensuring your customers’ digital experience is flawless, it’s also important to look inward at how you can improve efficiencies for employees. Because even when your offerings are shifting to digital spaces, there are still people behind the scenes, relying on their own suite of digital tools to do their jobs effectively.

Similar to in-app messaging offered to customers, with in-app training and onboarding on internal tools, you’re able to offer staff and field agents real-time guidance and assistance. This is especially helpful today when teams may no longer be working in the office together, and training for new hires must happen remotely (and quickly).

4. Enable rapid feedback collection

Rather than relying on email requests for customers to fill out a survey (which usually get ignored or lost in inboxes), a key step in unlocking these powerful insights is moving feedback collection in-app. This way, you can deliver CSAT or NPS surveys to customers while they’re using the app, making them more likely to respond with the most relevant answers. Especially as you launch any new digital offerings, knowing what customers think of (or want from) them will be extremely valuable in ensuring you’re meeting their needs.

Additionally, when feedback lives in multiple places (a response to a survey, a one-off request from a customer to their account rep, etc.), information can slip through the cracks and it’s difficult to make sense of any themes or what’s most pressing. With a feedback management system, you can capture customer feedback all in one place, giving you a view of recurring themes or which features your top accounts are asking for, and the ability to prioritize accordingly.

5. Deliver ongoing user education

Once customers start using your application, it’s important to make sure engagement doesn’t drop off. A lot of times, users get stuck in a digital product because they don’t know how to do something and feel like the application isn’t working for them anymore. This is when user education becomes crucial: you need to make sure users continue to get value from your app, especially as you add any new features or make improvements to existing functionality.

Similar to customer communications, think about how you can bring education materials inside the app itself, particularly for key actions you know lead to success. As a first step, determine which features customers are underutilizing with a focus on those that you know are the most valuable. Then, use in-app walkthroughs and tooltips to drive awareness and education for those features on an ongoing basis.

6. Increase transaction volume

Whether it’s the number of claims processed, policies sold, or accounts opened, success hinges on transaction volume for financial services providers. And your digital products should be a source of — rather than a barrier to — this increased engagement.

In order to drive more seamless workflows, you need to understand how users are navigating your app and where they may be getting stuck or dropping off while taking certain actions. For example, if you’re a bank you might notice a trend of customers bouncing from an online form to open a new account, and have a theory that it is because they don’t want to enter their social security number. Once you’ve identified an insight like this from your product data, you can address the issue directly, in this case by adding an in-app message explaining that this is a federal requirement and you won’t use their social security number for any other purpose.